The Central Bank of Kenya (CBK) has clarified the measures and mechanisms implemented by the government to regulate the activities of Buy Now Pay Later (BNPL) providers in the country.

The Central Bank of Kenya (CBK) has clarified the measures and mechanisms implemented by the government to regulate the activities of Buy Now Pay Later (BNPL) providers in the country.

The regulator disclosed the government’s plans to develop fair alternative financing models and empower Boda-Boda operators.

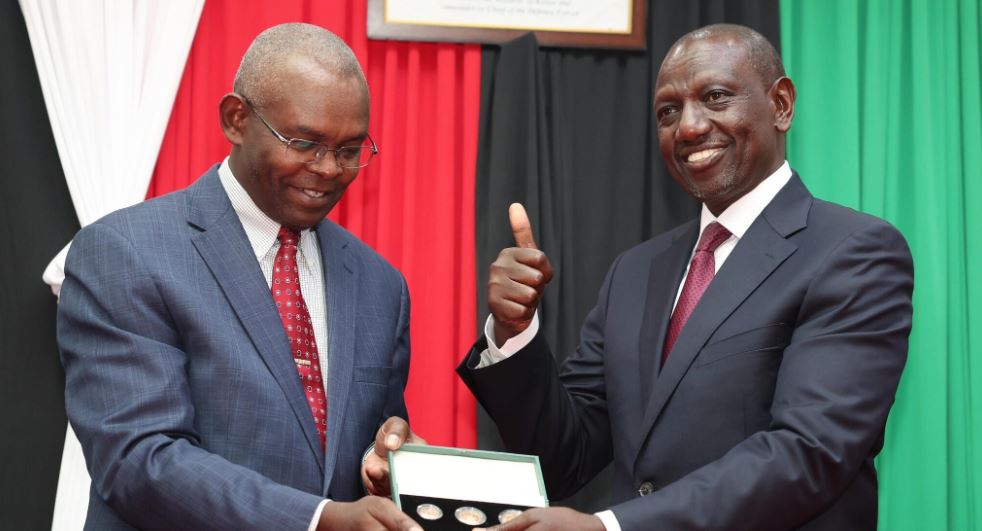

CBK Governor Dr. Kamau Thugge emphasized that BNPL companies’ operations fall within the definition of Digital Credit Business under the Central Bank of Kenya (Digital Credit Providers) regulations, 2022. He highlighted that these institutions are required to obtain licenses and be regulated by CBK.

Thugge noted that CBK’s mandate to license and supervise unregulated Digital Credit Providers (DCPs) was amended in December 2021.

He pointed out that CBK has received over 500 applications at various stages of review and licensing. These applications focus on ensuring the adequacy of corporate governance structures, viability of capitalization and business models, adequacy of infrastructure, processing human resources, and systems, as well as consumer protection and data protection mechanisms.

The Governor stated that these provisions and measures ensure adherence to relevant laws and safeguard the interests of customers to prevent rogue lending institutions from violating consumer rights.

Furthermore, he emphasized that the review includes specific administrative and enforcement actions against entities failing to comply with any provision of the law.

Thugge said CBK will engage specific licensed Digital Credit Providers (DCPs) including onsite inspections in cases of non-compliance of DCPs.

“Any affected boda boda operator is at liberty to lodge a complaint with CBK against a BNPL provider who has violated the law,” said the CBK Governor.

Moreover, concerning the government’s initiative to develop fair financial models that genuinely empower Boda-Boda operators, Thugge emphasized that the licensing of Digital Credit Providers (DCPs) aims to protect consumers from malpractices such as excessive pricing of their products.

He revealed that CBK collaborates with all licensed DCPs to ensure their pricing models are customer-centric and risk-based. Additionally, the institutions are expected to submit pricing models aligned with the regulations’ provisions.

Thugge reiterated that all product features and prices must undergo review and approval by CBK to ensure fairness, transparency, and empowerment for consumers accessing digital credit products. This applies to both ongoing licensed DCPs and all applicants.