Around the globe, technology is being employed in every field to ease and quicken the services of business entities to consumers. In this case, the financial sector, one of the fast-paced industries, is always quick to adopt innovations, and this has dynamically revolutionized the industry.

Many people no longer use cash and have resorted to digital platforms such as the use of mobile money, which enables them to conduct not only transactions of fiat currency but also digital currencies like Bitcoin and Ethereum.

But one can argue that some mobile money services operate locally or regionally, although a few have gone international such as M-Pesa. So, how can one send money from other countries to Kenya?

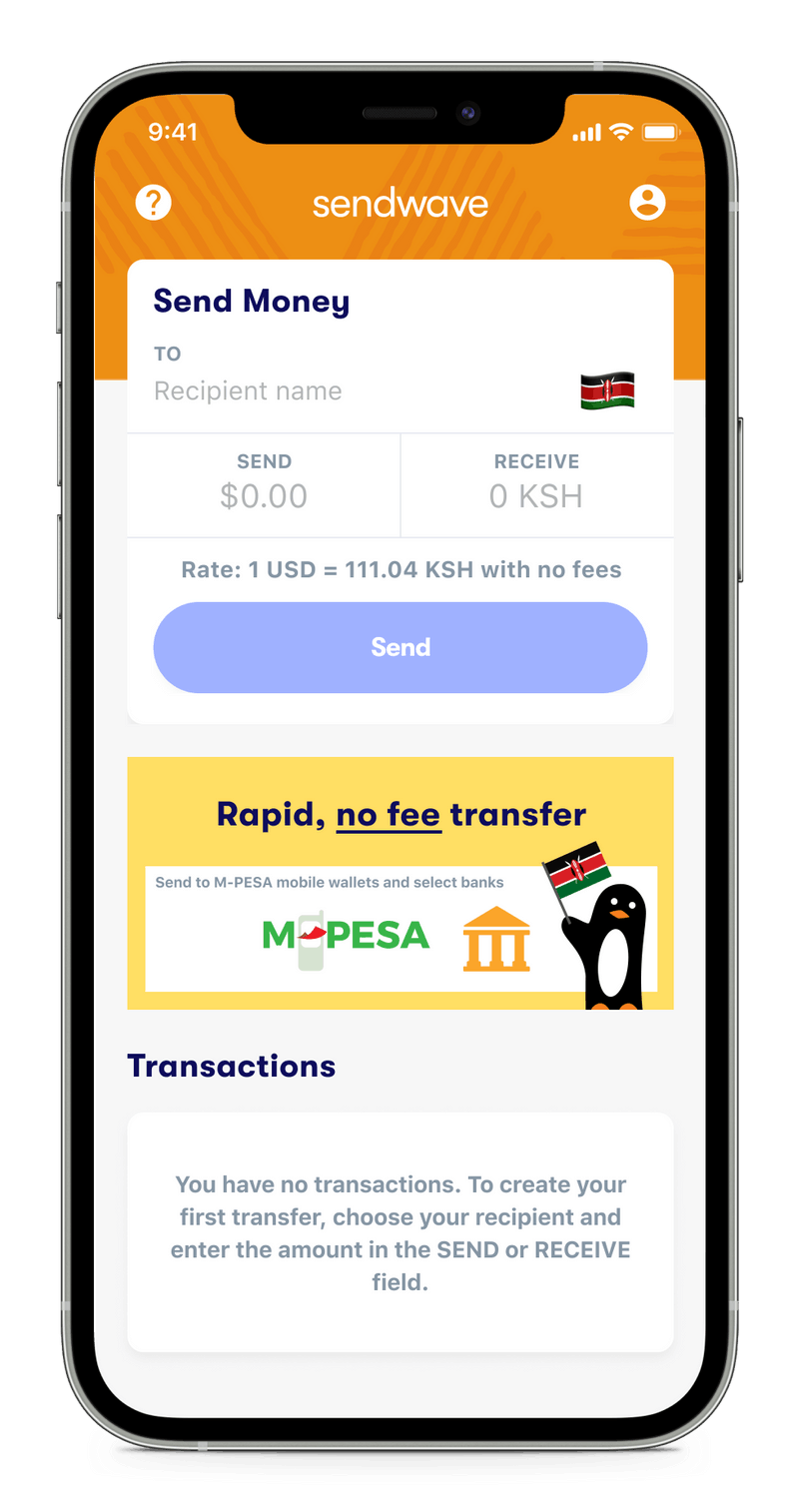

People who live or work abroad can now send money directly to M-Pesa using Sendwave, a financial technology service whose birth has discarded the hassles of using informal money transfer services such as Western Union and MoneyGram.

Sendwave is considered one of the best because money is received directly in M-Pesa, and it is withdrawable at any time. In Kenya, over 48 million customers use M-Pesa because of its convenience compared to banks, which do not operate on a daily basis, becoming risky to handle money received for emergency purposes.

What is Sendwave?

Sendwave is a financial technology service company that facilitates the transfer of money from country to country around the world. It was founded in 2014 by Drew Durbin and Lincoln Quirk, but it is the brainchild of Drew, who came up with the idea after he experienced difficulties when sending money to his NGO in Tanzania.

Currently, it has 400,000 users.

Which countries is Sendwave supported?

North America and Europe – USA, UK, Canada, France, Italy, Spain, and Ireland

Africa – Kenya, Uganda, Tanzania, Ghana, Nigeria, Senegal, Ivory Coast, Cameroon, Madagascar, and Liberia

Asia – Bangladesh, The Philippines, Vietnam, Sri Lanka, and Thailand

How to use Sendwave

You first need to download the Sendwave App on your mobile phone. If you are using Android or Chrome OS, the application is available on Google Play Store and Apple Store for IOS users.

After installing the Sendwave app, register a free account with your details, then link the account to your debit card or prepaid card, and you are good to go.

Money transfer: Sendwave to M-Pesa guide

You can send money via Sendwave to M-Pesa using the following guide because Sendwave is already integrated into the M-Pesa system.

1. Download the Sendwave App

2. Register a free account with details such as full name and date of birth

3. Link your Visa, MasterCard, or PostePay debit cards/prepaid cards

4. Verify your identity by submitting your original government-issued ID

5. Key in the first name and last name of the M-Pesa recipient

6. Enter the recipient’s mobile number

7. Enter the amount you wish to send

8. Send

The money will be received by the M-Pesa end-user within 30 seconds after sending.

Sendwave to M-Pesa transaction costs

Sending money from Sendwave to M-Pesa is completely free. Sendwave makes its money through the exchange rates of different currencies. The rates can be seen on the top bar of the app when making a transaction. The exchange rates are subject to change but have remained at 4.5% over time.

What is the maximum transaction amount on Sendwave?

Sendwave limits the amount a customer can send in a day or a month. The maximum amount to be transacted in a day is $999/£999/€999, and in a month, it is $2,999/£2,500/€2,500.

However, upon submission and approval of a photo and ID, one can send up to $12,000/£10,000/€10,000 a month.

What is the minimum transaction amount on Sendwave?

Sendwave customers are allowed to send a minimum of $1/ CAD 1 /1 Euro /1 GBP to their families and friends.

Sendwave customer care

Sendwave emails – [email protected], [email protected], [email protected]

Sendwave mobile numbers – +1 888 966 8603 (US/CA), +44 113 320 7935 (UK), +39 02 3057 8468 (Italy), +353 1800 949 226 (Ireland), +34 900 998 284 (Spain), +33 5 19 74 15 37 (France)