“Tulipe Ushuru Tujitegemee” – a famous phrase from the Kenya Revenue Authority (KRA) that calls upon Kenyans to pay taxes and become self dependent. Taxes are essential for funding development projects, as well as establishing incentives for the growth of many economic sectors in a country.

A good citizen pays taxes, and the first step toward being one is to register an account with KRA, where you will be filing your returns either monthly or yearly, depending on your assigned tax category based on your income pattern.

In the registration process of a KRA account and having a KRA PIN, you submit your information, declare sources of income and state your tax obligation before the details are submitted, pending approval.

How to check KRA registration status

Checking KRA registration status only applies to companies, self-help groups, business entities, and foreigners whose documents have to undergo utmost scrutiny before they are verified. Individual Kenyans (residents) applying for KRA PIN are given it within minutes of application. How can you check for KRA PIN registration?

1. Visit https://itax.kra.go.ke/KRA-Portal/

2. Click ‘Status Checker’ or visit https://itax.kra.go.ke/KRA-Portal/trackYrStatusController

3. In the Case Type, choose ‘Registration’

4. Enter your Reference Number and Search Code

5. Pass the security stamp by solving the arithmetic

6. Submit

KRA status checker will update you on your pending registration, and the information received will contain details such as what you applied for, taxpayer name, and applicant type.

How to check KRA payment status

You have recently filed your returns as mandated by the law. You should update your KRA portal to ensure that your payments are indicated to avoid attracting penalties from the Income Tax Department.

Business owners are mandated to keep proper records, and should therefore adopt technology in their invoices, receipts and more. Get a receipt template free online to ensure you are operating within the law.

How can you check your KRA payment status after filing returns?

1. Visit https://itax.kra.go.ke/KRA-Portal/

2. Select ‘Status Checker’

3. In the Case Type, select ‘Payment’

4. Input the Payment Registration Number – the unique number generated as an account number after filing returns

5. Enter the Search Code written at the bottom of the KRA payment slip

6. Solve arithmetic to pass the robot checker

7. Click the ‘Consult’ button to check the KRA payment status

In the generated information, you will see the application date, time, the applicant/firm name, revenue booking slip, and status. Received status is an indication that your payment was successful.

How to file KRA Nil returns

This is only applicable to residents and non-residents who have no taxable income. Here is how to file Nil returns in Kenya:

1. Visit https://itax.kra.go.ke/

2. Enter your KRA PIN

3. Enter your password

4. Solve the arithmetic as the security stamp

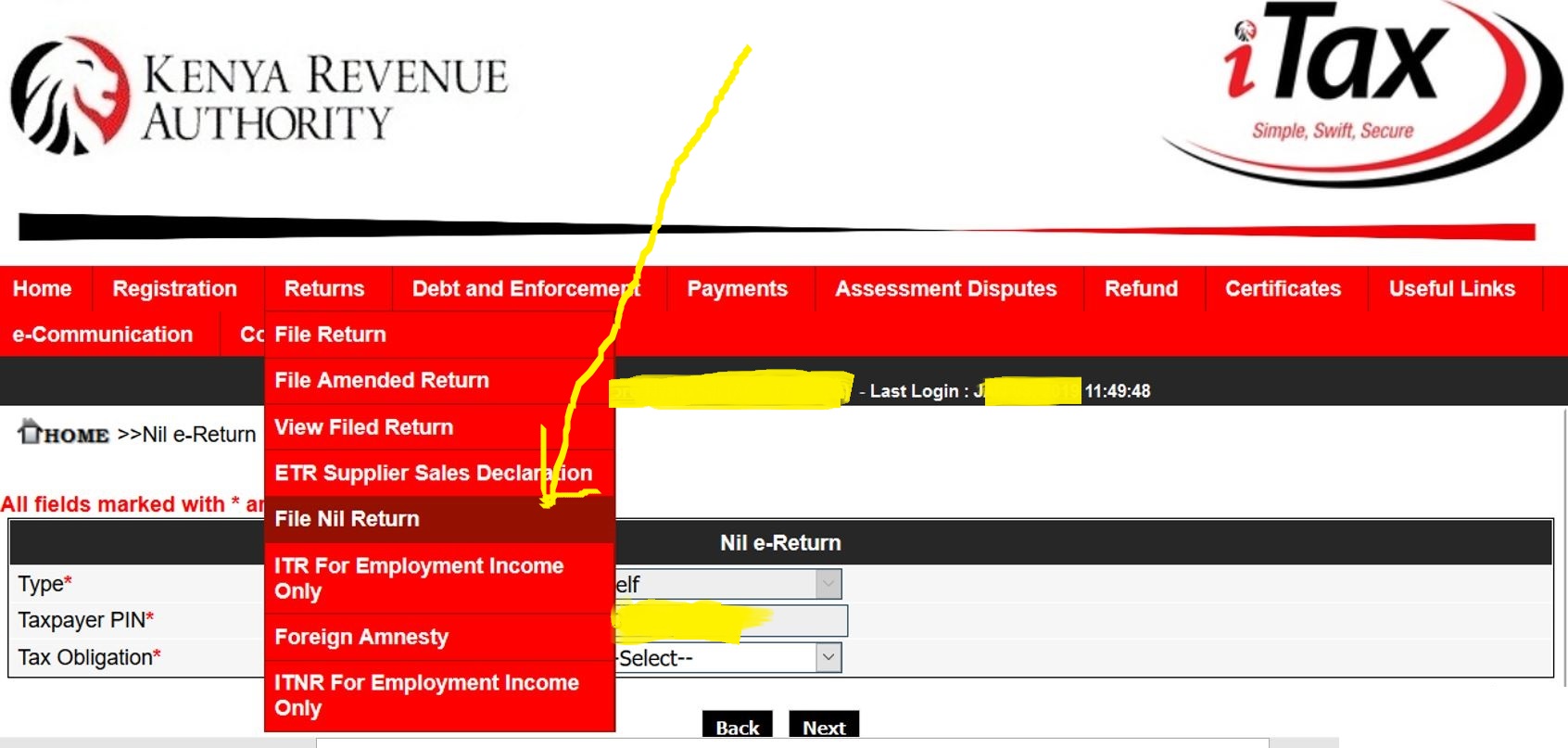

5. In the top bar, click ‘Returns’

6. Select ‘File Nil Returns’

7. Click next and switch tax obligation to ‘Income Tax – Resident)

8. Click next, and you will see the dates have been updated

9. Submit and download the return receipt

You have successfully filed Nil returns, and you are expected to do it once every year before June 30.