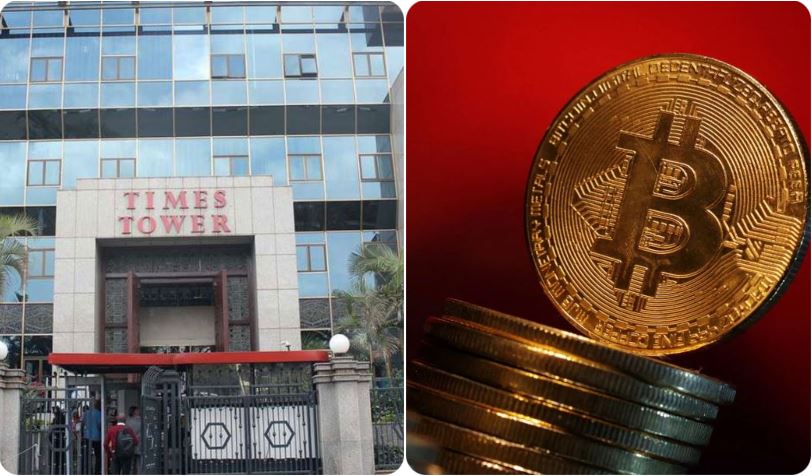

The Kenya Revenue Authority (KRA) is set to implement a real-time tax system that will integrate with cryptocurrency exchanges and marketplaces, allowing the agency to monitor and record transactions effectively.

The Kenya Revenue Authority (KRA) is set to implement a real-time tax system that will integrate with cryptocurrency exchanges and marketplaces, allowing the agency to monitor and record transactions effectively.

KRA announced this initiative while outlining its tax collection strategies for the fiscal year 2024/25, highlighting its intention to capture crucial transaction details, including the date, time, type, and value of each transaction.

The taxman explained that it has faced challenges in tracking and taxing cryptocurrency transactions due to an outdated system, which has led to significant revenue losses for the government.

The tax authority estimates that Kenya’s cryptocurrency market transacted approximately Kes.2.4 trillion between 2021 and 2022, amounting to nearly a fifth of the country’s gross domestic product (GDP).

KRA reiterated that the new system will enhance its ability to track and record transactions from cryptocurrency exchanges and marketplaces, ensuring compliance with Section 3 of Kenya’s Income Tax Act, which allows taxation on earnings from crypto transactions.

“Although the sector remains unregulated by reporting authorities like the Central Bank of Kenya and the Capital Markets Authority, earnings from this sector are legally taxable,” the tax authority stated.

The agency noted that the lack of a robust system for collecting taxes on cryptocurrency transactions has contributed to substantial revenue losses.

“Our goal is to establish a robust and efficient system that will enable KRA to collect taxes on cryptocurrency transactions effectively,” KRA affirmed.

Additionally, a new bill introduced in Parliament last year seeks to impose taxation on cryptocurrency transactions and digital wallets.

The Capital Markets (Amendment) Bill, 2023, proposed by Mosop MP Abraham Kirwa, aims to amend the Capital Markets Act, Cap. 485A, to include digital currency in the definition of securities. If passed, this amendment would empower KRA to levy capital gains tax on exchanges and excise duty on transactions.

The National Assembly Finance Committee has already approved the bill, which is currently under review in Parliament.