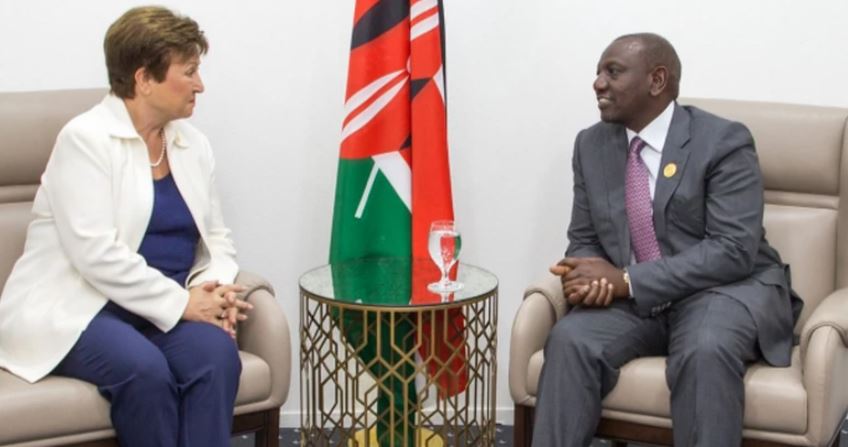

The Kenyan government has committed to monitoring the financial activities of high-ranking politicians, including President William Ruto, as part of a deal with the International Monetary Fund (IMF).

The Treasury has assured IMF that from next year, the government will track the flow of cash of politically exposed persons(PEPs), including their bank accounts, to ascertain their known sources of income.

The move is aimed at preventing the country from being locked out of the global financial system for money laundering.

This comes as the Financial Reporting Centre (FRC), Kenya’s anti-money laundering watchdog, is preparing changes to the Proceeds of Crime and Anti-Money Laundering Act and Regulations.

The amendments will require financial institutions to reveal sources of cash for top politicians, families and business associates.

The changes in the law follow a damning report by an international anti-money laundering team that identified deficiencies in Kenya’s 10-year-old anti-money laundering law on reporting financial transactions done by politically exposed persons (PEPs).

PEPs include the president, ministers, MPs, parastatal CEOs, high-ranking judges, high-ranking military officers, and board members of top firms.

“To help prevent the laundering of illicit proceeds from corruption, the authorities plan by end-June 2023 to submit to the National Assembly, draft amendments to the Proceeds of Crime and Anti-Money Laundering Act and Regulations to address gaps in the AML/CFT legal framework, including requirements on politically exposed persons [PEPs], in line with FATF standards,” the IMF said in a report after approving a Sh55.07 billion ($447.39 million) disbursement to Kenya on Monday.

“To this end, the authorities aim to prioritize ensuring compliance by banks with enhanced due diligence measures for higher risk customers, including PEPs, through AML/CFT risk-based supervision.”

The amendments to Kenya’s money laundering law will be based on the requirements set by the global watchdog for money laundering and terrorist financing, FATF. The laws are followed in developed countries.

FATF requires financial institutions to conduct “enhanced ongoing monitoring” of business relationships involving PEPs.

Financial institutions, led by banks, will be required to conduct enhanced scrutiny of their entire business relationship with a PEP and make a suspicious transaction report to the FRC if higher risks are identified.

Besides reporting unusual financial dealings, the Proceeds of Crime and Anti-Money Laundering Act (Procamla) requires designated firms to submit to the FRC an annual compliance report by January 31 of the following year.