In Kenya, one of the best investment options that guarantee high and quick returns is money market funds – also money market mutual funds – it is a type of mutual fund that invests in short-term instruments while maintaining the liquidity of the current account hence deposits are accessible for withdrawal anytime.

It has a higher capital appreciation compared to normal savings at the bank, but it is not suitable for long investments as the funds’ maturity period is usually after a year, depending on the terms issued by the fund managers, which are regulated by the Capital Markets Authority (CMA) and Retirement Benefits Authority (RBA).

Before investing in a money market fund in Kenya, consider checking their daily interest rates compounded monthly, promptness of payment when withdrawing redeemable units or shares to investors, and the stability of the fund managers.

Why invest in a money market fund in Kenya?

Because it is low risk as the fund managers invest in ‘stable’ debt-based securities with a short-term maturity, such as Treasury Bonds and Bills. For this, it is a good place to keep your hard-earned money as you are sure of not losing it. However, you should note that when Net Asset Value per Share drops, the loss is borne by the investor, and you may get less money than what you invested.

Requirements for investing in a money market fund in Kenya

* Money market funds application form from a licensed fund manager

* KRA PIN

* National ID or passport

* Passport size photo

* Kenyan bank account details of the applicant

What are the best money market funds in Kenya?

The best money market funds in Kenya proffers a blend of low risk, expense ratio, and a positive yield to the invested funds. To come up with this selection of the top 5 best money market funds in Kenya, NairobiWire combed through a list of the fund managers on merit – lowest expenses and high yield through side-by-side comparisons taking into account the accrued daily interests.

Here are the top 5 best money market funds in Kenya:

1. Sanlam Money Market Fund

2. Cytonn Money Market Fund

3. Zimele Money Market Fund

4. Madison Money Market Fund

5. CIC Money Market Fund

Sanlam Money Market Fund

Sanlam Money Market Fund is a product of Sanlam Kenya PLC listed on the Nairobi Securities Exchange (NSE) under the ticker symbol ‘SLAM.’ It aims to deliver high level of income than fixed savings accounts through earning of monthly interests to suit risk-averse investors who are wary of market volatility. It has a conservative risk profile and a portfolio size of over Ksh10.1 billion since its inception in November 2014.

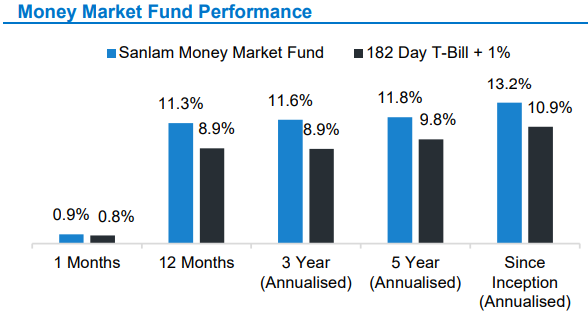

In the latest Sanlam Money Market Fund performance report released in April 2022, the gross yield was 0.9%, and interests accrued on invested monies were 11.3% in the past twelve months.

The minimum amount to invest in Sanlam Money Market Fund is Ksh2,500. To join, you simply deposit Ksh2,500 to Mpesa pay bill number 888111, download and fill out the applications form here and submit it to clientservice@sanlameastafrica.com or WhatsApp number +254793377373.

Sanlam Money Market Fund contacts

Website – www.sanlam.co.za/kenya

Head Office – Sanlam Tower, off Waiyaki Way, Westlands, Nairobi

Phone number – +254(0)20278100

Email – info@sanlam.co.ke

Cytonn Money Market Fund

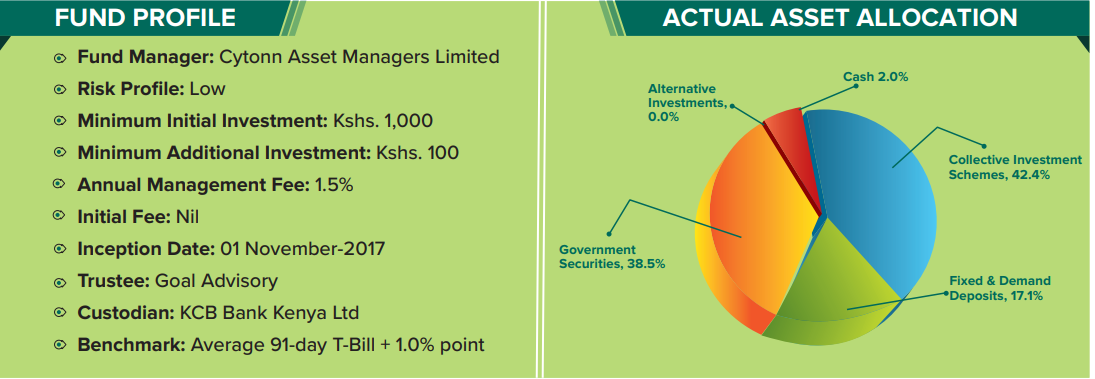

Cytonn Money Market Fund (CMMF) is a product of Cytonn Asset Managers Limited (CAML) that offers all investors an ideal investment option as a drive toward financial security.

CMMF invests in high-quality interest-bearing investments and commercial paper with an assurance of capital preservation. Over the past 12 months, its interests have been capped at 11% p.a. with an annual management fee of 1.5% p.a.

You can join Cytonn Money Market Fund by USSD service *809# or download the application form here. The minimum amount to invest is Ksh1000, and the maximum you can invest or withdraw is Ksh300,000.

Cytonn Money Market Fund contacts

Website – www.cytonn.com

Head Office – 6th Floor, The Chancery, Valley Road, Nairobi

Phone number – 0709101200

Zimele Money Market Fund

Zimele Money Market Fund or Zimele Unit Trust was incorporated in August 1998 under Zimele Asset Management Company Limited, and it has been managing pooled funds for over two decades. Its trustee to safeguard the interests of the members is KCB Bank, while its custodian of managing all the financials is Standard Chartered Bank.

If you want to build savings for a car, construction, school fees, or maintaining business cash flow, then Zimele Savings Plan is the best option for you. To open a Zimele Money Market Fund account, you must make a deposit of Ksh100 with no minimum account balance or top-ups. You can save the little amount you have through either; Mpesa or a bank account.

Zimele Money Market Fund has a competitive interest rate of 9.56% p.a., but you can choose to liquidate either a part or all the funds in your account anytime.

Zimele Money Market Fund contacts

Website – www.zimele.co.ke

Head Office – EcoBank Towers, 7th floor, Muindi Mbingu Street, Nairobi

Phone numbers – 0722207662, 0734207662

Madison Money Market Fund

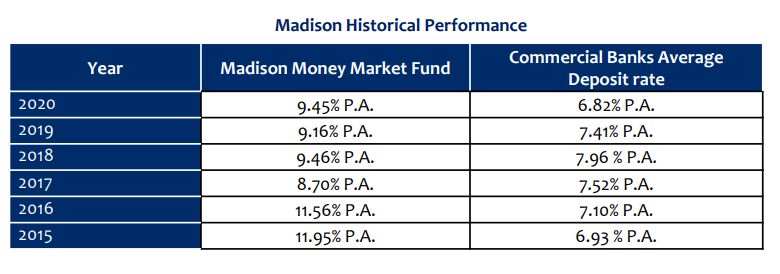

Madison Money Market Fund is the best investment avenue for investors seeking rapid capital growth with low risks. The Fund invests in short-term debt securities that do not exceed 12 months.

The initial investment at Madison Money Market Fund is Ksh5,000, and the minimum amount to top up your investment is Ksh1,000. It is not contractual thus, withdrawing your funds before the maturity period is not penalized. Withdrawals take two days to be processed.

The 2022 daily yield at Madison Money Market Fund is 9.10%, while the effective annual yield is 9.53%.

To join this Fund, you can dial Madison USSD *828# or contact them through:

Madison Money Market Fund contacts

Website – www.madison.co.ke

Head Office – Madison House, 2nd floor, Upper hill Close, Nairobi

Phone number – +254202864500

Email – madisoninvestmentmanagers@madison.co.ke

CIC Money Market Fund

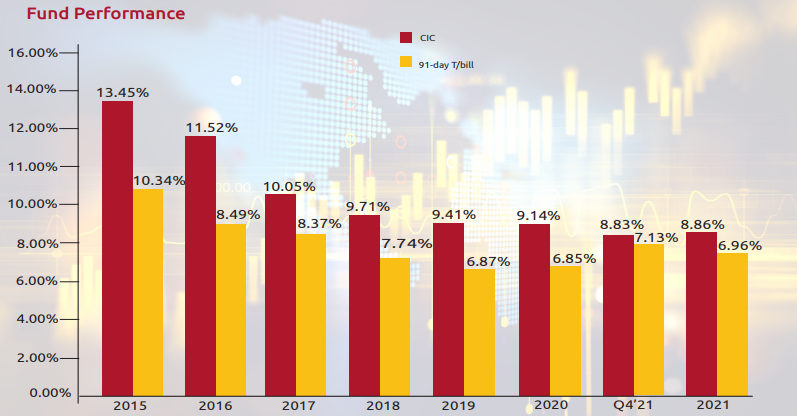

Like all the others, CIC Money Market Fund invests in short-term debt instruments with less than 12 months maturity period. It offers a competitive interest that is calculated daily and

credited at the end of each month. Depositing large sums negotiates higher returns as the interests are calculated respective to the deposits.

The minimum amount to invest with CIC Money Market Fund is Ksh5,000, with Additional investments of not less than Ksh1,000. Its annual management fee is 2%, while the effective annual yield is 8.86%.

The key benefits of the CIC Money Market Fund are liquidity as you can withdraw your funds on short notice without penalties, flexibility, and security. To join, check out the application form here.

CIC Money Market Fund contacts:

Website – www.cic.co.ke

Phone number – 0703 099 120

Email – callc@cic.co.ke

SUMMARY: Money Market Funds in Kenya 2022

The table below will compare top money market funds in Kenya against their daily yield and effective annual rate.

| Rank | Fund Manager | Daily Yield | Effective Annual Rate |

| 1 | Sanlam Money Market Fund | 10.71% | 11.3% |

| 2 | Cytonn Money Market Fund | 10.44% | 11% |

| 3 | Zimele Money Market Fund | 9.13% | 9.56% |

| 4 | Madison Money Market Fund | 9.10% | 9.53% |

| 5 | CIC Money Market Fund | 8.49% | 8.86% |

| 6 | Standard Chartered SC Shilingi Funds | 8.62% | 9.00% |

| 7 | ICEA Lion Money Market Fund | 8.07% | 8.4% |

| 8 | Britam Money Market Fund | 7.92% | 8.24% |

| 9 | AA Kenya Shilingi Fund | 7.42% | 7.7% |

| 10 | Old Mutual Money Market Fund Kenya | 7.05% | 7.3% |

Also read: Top 10 Businesses You Can Start With Ksh100,000 in Kenya