Life doesn’t go always as planned and when things go South, not everyone has bank savings to deal with financial emergencies.

The financial sector has embraced modern technology by streamlining many of its services like loan access and customers can now get loans in a matter of minutes just by applying through their mobile phones with stable internet.

Mobile loan services in Kenya involve no paperwork and banks are rapidly adopting the new culture lest they lose clients. Loan apps are convenient because of the same-day approval of credit and thus qualify to be useful in cases of emergencies.

Mobile Apps Offering Quick Loans to Kenyans

Here are the best loan apps that offer loans instantly in Kenya:

1. Branch loan

2. Berry loan

3. Tala loan

4. KCB Mpesa

5. Timiza loan by Absa Bank

6. Zenka loan

7. Okash loan

8. Safaricom Fuliza Mpesa

9. MCo-op Cash

10. Saida loan

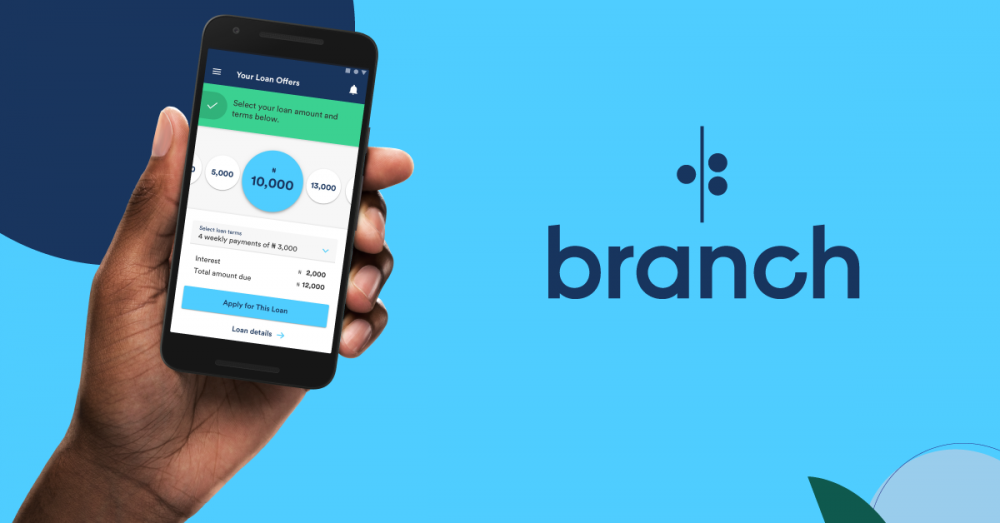

Branch loan

Branch loan is among the most popular loan apps in Kenya that leverage the power of technology to offer affordable loans to Kenyans after seconds of application.

It is owned by Branch International, which was started in Kenya in 2015 by Branch International Holding Limited, incorporated in Mauritius but wholly owned by Branch International Inc (BI) from the State of Delaware in the United States of America.

The minimum loan amount you can get from the Branch loan app is Ksh250, while the maximum amount is Ksh100,000. The repayment period is 4-52 weeks with an average monthly rate of 1.7% – 17.6%.

Recently, Branch acquired 84.89 percent shareholding of Century Microfinance Bank Limited (Century MFB), and it looks forward to revising its financial operations. Branch’s total assets stood at Ksh.1.1 billion as of December 31, 2020.

Download Branch loan app from Google Play Store or Apple Store and enjoy its services.

Berry loan

Berry loan app is a subsidiary of Finberry Capital Limited. It provides swift and low-cost loans to Safaricom Mpesa users that have flexible repayment terms.

Its credit facilities range from Ksh500 to Ksh50,000, but repaying your loans on time will increase your loan limit.

Tala loan

Tala loan is famous for its inclusive program of offering consumer credit to customers regardless of their credit history. It was started by Shivani Siroya and currently operates in Kenya, Mexico, India, and the Philippines.

You can download the Tala Loan app from the Google Play Store and access loans of Ksh2,000 to Ksh30,000 with rates as low as 5%.

KCB Mpesa

KCB Mpesa is a product of Kenya Commerical Bank in partnership with telco giant Safaricom. All Safaricom customers can access KCB Mpesa so long as they are registered on Mpesa.

It offers unsecured loans of between Ksh50 to Ksh1 million at a monthly rate of 7.5% with a repayment period of 30 days, and customers can borrow multiple times within their limit.

Timiza loan by Absa Bank

With the Timiza loan app, not only can you borrow affordable loans of low rates of below 5% but also buy airtime, pay utility bills, save with Zidisha, request a cab, and get insurance cover. It is a financial technology service by Absa, former Barclays Bank.

Timiza loan services can be accessed by Safaricom users through USSD *848# (costs Ksh1) or by downloading the Timiza loan app from Google Play Store or Apple Store.

Timiza loan limits are Ksh50 to Ksh1 million with a repayment period of a month.

Zenka loan

If you want to get a loan within 5 minutes after application, download the Zenka loan app and apply now because their first loan is interest-free and has a repayment period of up to 61 days.

They give quick loans from Ksh500 to Ksh45,000 with a minimum processing fee of Ksh45. The processing fee is 9-39% of the principal amount.

Okash loan

Okash was started in 2018 and has since been offering Kenyans quick loans with no documentation. People between 20-55 years with a fixed income and a registered phone number can apply for a loan in the Okash app available in the Google Play Store.

Okash gives loans of up to Ksh500K with a repayment period of 365 days and a rate of 36% per annum.

Safaricom Fuliza Mpesa

Safaricom Fuliza is an overdraft credit facility that allows customers to transact even when they are low on funds in their Mpesa wallet. It was launched in 2019 in partnership with Kenya Commerical Bank (KCB) and NCBA bank.

To activate Fuliza, you must be an active Mpesa user. Registration is done via UUD service *234# or via Safaricom Mpesa app.

Fuliza credit facility is Ksh1 to Ksh70,000 and allows customers to transact within the allocated limit calculated based on how you use Safaricom and M-PESA services.

It charges a processing charge of 1% on the principal amount and a subsequent daily fee determined by the amount borrowed.

Here are Fuliza charges for 2022 (Normal Mpesa charges apply).

| Band | Tariff | Promotional Tariff for 30 day from launch |

| Ksh0 -Ksh100 | One-time fee of Ksh2.4 | One-time fee of Ksh0 |

| Ksh101-Ksh500 | Ksh6 per day | |

| Ksh501-Ksh1,000 | Ksh12 per day | |

| Ksh1,001-Ksh1,500 | Ksh24 per day | |

| Ksh1,501-Ksh2,500 | Ksh30 per day | |

| Ksh2,501-Ksh70,000 | Ksh36 per day |

MCo-op Cash

MCo-op Cash is an integrated mobile application by Co-operative Bank Kenya. Aside from giving affordable loans of 1.5% or double your net salary, it allows seamless transactions and monitoring of your bank account by accessing your account’s dashboard.

You can register on Mco-op Cash by dialing USSD *667# or download MCo-opCash App from application stores. Registration is instant and free.

MCoop Cash offers two types of loans – Salary Loans and Business Plus Loans – with different acquisition criteria.

MCo-op Cash Salary Loan limit ranges from Ksh1,000 to Ksh500,000 with an insurance fee of 0.0034% and rates of 8% for a 1-month loan, 10% for 2 months loan, and 12% for 3 months loan that is deducted upfront.

For Business Plus Loans, you can apply for a minimum of Ksh100 to Ksh1 million depending on your loan limit, determined by your CRB credit score.

Also, you can only apply for a loan if you have an active account with Co-operative Bank that has been operational for the last six months.

MCo-op Business Plus Loan charges are a one-off appraisal fee of 3% of the loan amount applied for, a commission of 1.5% per month of the loan amount applied, and insurance of 0.034% pm.

Saida loan

Saida loan app offers credit for Safaricom and Airtel customers. Saida tracks your transaction history on your phone before determining your loan limit.

It gives loans of Ksh100 to Ksh50,000.

How to Qualify for a KCB Mpesa Loan

Here are the eligibility requirements of KCB Mpesa:

* Must be above 18 years, hold a national ID

* Be a registered Safaricom and Mpesa user

* Must have used Mpesa for at least six months

* Have a KCB Mpesa account