Managing your money saved in an Equity Bank account has been made easier thanks to their partnership with Safaricom’s mobile money transfer service Mpesa.

These days, you do not need to go to a bank agent or rush to be the first on the long bank queues but just wire your money to Mpesa using the simple systems put in place to get the funds on your mobile wallet and withdraw it conveniently in thousands of Mpesa outlets available countrywide. This will save you a great deal of time and money which you could perhaps use as transport on your journey to the bank.

Some of the methods customers can use to withdraw money from Equity bank to Mpesa include; using the Equitel line, Equity Eazzy Banking App, USSD (*247#), and internet banking.

So, how can you withdraw money from Equity Bank to Mpesa? Here is the Equity money transfer to Mpesa guide:

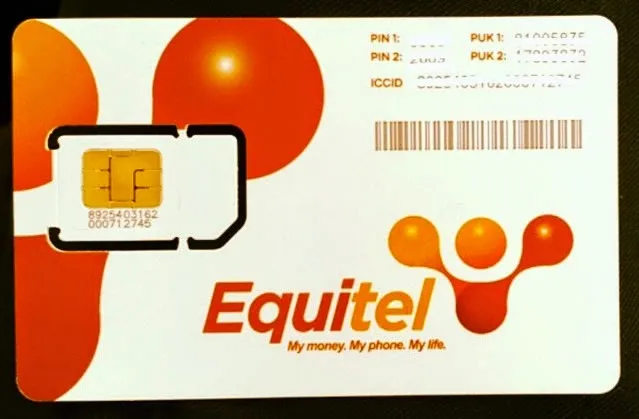

How To Transfer cash from Equity to Mpesa Using Equitel

Equitel is a virtual mobile network that is a subsidiary of Equity Bank Group. It was founded in 2015 to provide a favorable platform for customers to transact on their bank accounts.

As much as it allows its users to send and receive money from banks, it also accommodates Mpesa transfers, and here is the guide on how to send cash from Equitel to Mpesa.

1. Tap on your Equitel sim toolkit on your phone

2. Select the ‘My Money’ option

3. Go to the ‘Send/Pay’ option

4. Choose the Equity bank account number you want to withdraw from and press OK

5. Choose the ‘To Others’ option

6. Select Mpesa

7. Now enter the Mpesa recipient’s mobile phone number

8. Now enter the amount you wish to transfer

9. Double check if you have entered the correct mobile phone number and amount

10. Enter your secret Equitel PIN and press OK to confirm the withdrawal.

You’ve done it! You will receive a withdrawal SMS from Equity Bank indicating the date and time of cash withdrawal, recipient’s details, money sent, and bank balances. On the other hand, the Mpesa customer will get a Mpesa message indicating the reception of funds in the mobile wallet.

How To Transfer cash from Equity to Mpesa Using Equity mobile app – Eazzy Banking

In November 2016, Equity Bank Group launched its revolutionary digital banking platform dubbed Eazzy Banking which allows its customers to manage their accounts, track finances and even reach customer care.

The app offers comprehensive banking services, and Equity money transfers using internet banking to Mpesa is one of them. How do you transfer money using the Equity mobile app (Eazzy Banking) to Mpesa?

1. Download the Eazzy Banking app on Google Play Store (Android users) or Apple Store (iPhone users)

2. Launch the app and link your Equity bank account

3. Go to the homepage and select the ‘Mpesa’ option

4. On the dialogue box, enter the Mpesa mobile number you would wish to send money to or choose from your phone book

5. Enter the amount you wish to transfer to the Mpesa user

6. Enter your PIN to initiate the withdrawal process

7. You will receive a unique code from Equity via SMS

8. Enter the code to complete the transaction

It takes seconds, and you are done. You will receive an SMS confirming the transfer of funds from your Equity Bank account.

How To Transfer cash from Equity to Mpesa Using *247#

Initially, Equity Bank’s USSD code,*247#, was accessed only by Equitel Customers, but in February 2022, the financial institution announced that it had revamped its services to suit customers using all mobile networks. Today, Equitel, Safaricom, Airtel, and Telkom users can access USSD service *247#.

Some of the features available on the platform include access to loans, self-registration of new customers, account management, plus transfer of funds to mobile money platforms such as Mpesa. How can you transfer money from Equity Bank to Mpesa using *247#? Here is an easy guide:

1. Dial *247# on your phone

2. Login with your Equity Bank account details you want to withdraw money from

3. On the main menu, go to the ‘Withdraw’ option

4. Select ‘Withdraw to Mpesa’

5. Enter the Mpesa mobile number you want to send money to

6. Enter the amount you wish to transfer

7. Double check the number and amount before pressing ‘Confirm’

8. Confirm the transaction

Done! You will receive an SMS from Equity Bank confirming the withdrawal process from the Equity Bank account to Mpesa.

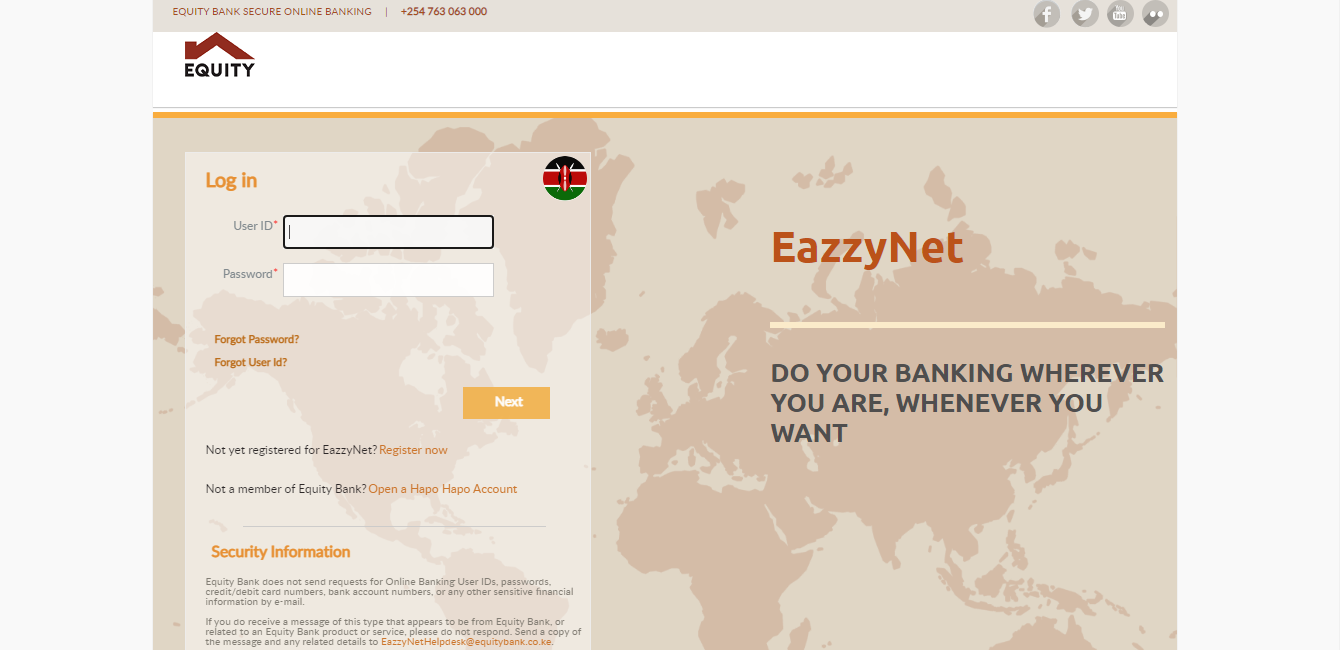

How To Transfer cash from Equity to Mpesa Using Internet Banking

Equity internet banking, EazzyNet, was launched to enable customers to manage their accounts anywhere, even overseas.

Eazzynet allows users to transfer money from Equity Bank to Mpesa using simple procedures that require no practical skills.

To withdraw cash from Equity bank using EazzyNet internet banking, simply follow these steps:

1. Visit Equity Bank’s website – online.equitybankgroup.com

2. Login with your user ID and password

3. Navigate to ‘Withdraw Funds’

4. Choose ‘Mpesa’

5. Enter the Mpesa mobile number you would like to withdraw to

6. Enter the amount to transfer

7. Double check the details – Mpesa mobile number and amount

8. Confirm the transaction

You will receive a notification via email indicating the withdrawal process conducted on your Equity Bank account.

How much money does it cost to transfer from Equity to Mpesa?

Equity has made it possible for customers to easily transfer funds from their bank accounts to Mpesa.

What is the minimum/maximum amount of money transferable from Equity to Mpesa? The minimum amount to be sent to Mpesa is Ksh100, and the maximum amount one can send to Mpesa is Ksh35,000 per transaction with a daily limit of Ksh140,000.

What are the charges of equity money transfer to Mpesa? Here is the table showing the amount ranges against its transaction cost for 2022.

| Band No. | Amount | Transaction cost |

| 1 | Ksh50 – Ksh100 | Ksh34.10 |

| 2 | Ksh101 – Ksh500 | Ksh38.50 |

| 3 | Ksh501 – Ksh1,000 | Ksh44.00 |

| 4 | Ksh1,001 – Ksh1,500 | Ksh49.50 |

| 5 | Ksh1,501 – Ksh2,500 | Ksh60.5 |

| 6 | Ksh2,500 – Ksh35,000 |

How to check your Equity bank balance

Even though Equity Bank is one of the best banks in Kenya, it must adopt timely technological advancements as a move to outplay its competitors in the field of commerce.

Some of the radical changes it has adapted to ease its client service include formulating straightforward ways for customers to check their account balances? How can you check your equity account balance?

Check Equity balance on Equitel

1. Open Equitel sim toolkit

2. Navigate to the main menu and tap ‘My Money’

3. Select ‘Bank Balances’

4. Enter the account number or click on the account you want to check the balance

5. You will receive a prompt to either check temporarily on-screen or receive account balance details via SMS

6. Choose your desired means

7. Enter your pin to finalize the process

Check Equity balance on the Equity Eazzy app

1. Open the app on your phone

2. Login using your details such as account number and PIN

3. Go to My Account dashboard and check your balance

Check Equity balance using USSD *247#

1. On your phone, dial *247#

2. Login with your credentials

3. Press ‘Balance’ option

4. Select one of the accounts displayed, all accounts, mini or full statement via mail

5. After selecting one specific account, you will receive a prompt to; either choose a screen display of your balance or an SMS with your account balance. Choose your desired means

6. Enter your PIN to complete the process

Check Equity balance online using internet banking – EazzyNet

1. Open your browser

2. On the address bar, enter online.equitybankgroup.com

3. Login using your user ID and password

4. After logging in, you will be directed to the homepage. Click ‘Accounts Summary Section’

5. Check your balances which are displayed in the section.

How to get your Equity bank statement Online in Kenya

Equity Bank statements, just like other banks’ statements, are a record of transactions of a customer’s account in terms of money paid into it and money withdrawn from it at a certain duration of time.

They are usually issued by an automated bank system upon the request of the account holder.

Accounts statements are in two forms; a full statement and a mini statement. A full statement is a record of transactions over a period of time; it can be monthly or yearly, while a mini statement contains a list of a few transactions, mostly less than ten.

You may request a bank statement to track financial goals by monitoring your spending, or a financial institution may ask you to submit one in order to facilitate loan processing by determining your financial profile. Here is how to get your Equity Bank statements in Kenya:

How to get Equity Bank statement using Equitel

1. Go to Equitel sim toolkit

2. Go to ‘My Money’

3. Go to ‘Bank Balances’

4. Choose ‘Mini Statement’ or ‘Full Statement via Email’

5. Select account

6. Enter your desired start date of the account statement

7. Confirm by entering your PIN

Mini statements are usually sent via SMS, while full statements are wired to your email.

How to get Equity Bank statement using Eazzy app

1. Open the Eazzy app on your phone

2. Login using your credentials

3. Go to ‘My Account’

4. Click on ‘Statements’

5. Choose the duration of your statement

6. Confirm the process

You will get your full statement in your mailbox.

How to get Equity Bank statement using USSD *247#

1. Dial *247# on your mobile phone

2. Click on option 1 – ‘Balance’

3. You will be redirected to a menu with ‘Mini Statement’ and ‘Full Statement’ options

4. Choose your desired statement type

5. Select an account which you want its statements

6. Enter your PIN to validate the operation

Full statements are sent by email, while mini statements are conveyed via SMS inbox.

How to get Equity Bank statement using internet banking – EazzyNet

1. Open website – online.equitybankgroup.com

2. Go to ‘Accounts Section’

3. Click on ‘Full Statement,’ which will be posted to your email

You will receive your bank statements instantly.