Trading in forex does not only mean that you are selling or buying a currency. Forex has many processes and values to consider before you make the next step and calculate the loss or profit. To ease the princess, all traders use the PIP calculation process.

When you are calculating the trading options, you need to consider the minute decimal points as well because they make a great impact when you calculate the total profit/loss. Differentiation of a minor mistake can result in a huge loss if not calculated properly. For this, the Pip value calculator is widely used in all forex markets.

Before you know when to use the pip calculator, it is necessary that you understand what it is and the benefits of it.

What is a pip calculator?

PIP stands short for ‘ price per interest’ or ‘ percentage in point.’ It is basically the smallest price move that an exchange forex rate can make. The calculation is based on the forex market convention process and is the same throughout the world.

Pip stands fourth in the decimal series of calculation which is also the last. There are no other decimals after that.

Use of PIP calculation:

As we discussed that the pip is the last value in the decimal series, you can simply state it as, 0.0001.

Merely saying that when you trade in currency pairs, you would do so when you calculate the difference in exchange simultaneously.

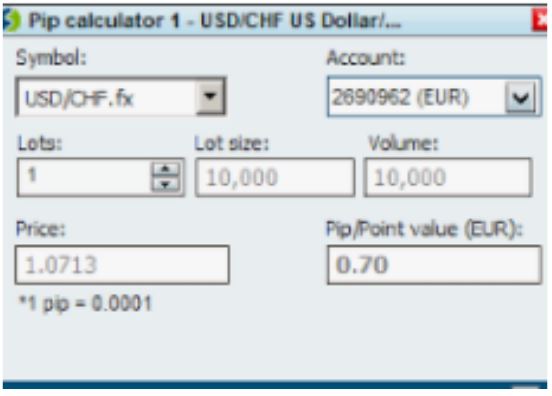

How to use the PIP calculator:

Before we embark on the journey to using the pip calculator, there are few things which you need to understand.

1. Currency trading is always done in pairs. The reason is that you need to identify the buy and sell price and that is when you calculate the pip.

2. Trade size is measured in ‘lot/s’. Example, 100,000 units are considered as 1 lot. Remember, that the price of lot/s can vary according to the market shares and price daily.

3. Keep a check on the deposit currency, that is where you will hit the pip value and see if you have a profit or loss.

Now coming towards the use of a pip calculator, here are the steps.

Let’s take an example of EUR/USD=1.1017

0.0000%exchange rate is equal to the pip rate.

So, 0.0001%1.1017= 0.00009

This is the simplest means of how to use the calculator, but of course there are online pip calculators available on the internet where you need to put in the currency details and the calculator will do all the hard work for you.

When to use the pip calculator?

Trading in foreign currency matters a lot especially when even a decimal can change the whole lot of profit into a loss. So, below are the reasons why and when you should use a pip calculator.

1. Helps trading to a great extent:

If you are using the pip calculator, then you can make the proper decisions in the forex industry. It gives a good idea of the trading situation so you can estimate the amount you want to trade. Furthermore, you can assume the risks you can take with each transaction which is the most important of all decisions.

To keep it simple, you can be careful as to what and the amount to trade.

2. It is for all traders:

The good part is that everyone can use the pip calculator regardless of the location, age and race. Since it’s the smallest decimal, it is relevant in all forex trades to glean the useful information especially if you don’t have a pattern to follow.

Moreover, if you have recently stepped into trading, then the pip is a definite to use.

3. Simple to use:

The best part is that pip is really easy to use. You can use it with all currency and have immediate results. It is the only calculator that will provide accurate results.

That is the reason that all traders including the forex brokers use it daily and for every transaction.

4. For all currencies:

Usually, forex is USD. That is another reason why most brokers use pip because that pip is pretty standard and is easy to figure out the end result. Generally, most of the trading pairs have USD so pip is important as a standard calculator.

5. Minimum risk:

When you calculate, you do for the profit and loss, without any calculator you might end up plunging into the loss. Hence, you can reduce the risk of loss by calculating the forex market prices upto the decimals.

Benefit of Pip calculator:

Most of the traders would say they reject the use of pip calculators as they rely on their inner feelings and gut for a successful trade. But sometimes, the loss is a lot, so to reduce the risk, calculation is important.

You can have the precise information which will increase the chances of profits making the right decisions all along the way.

The pip calculator is available online and without any cost, so basically there is no harm in calculating the risk factors.

It will also help you forecast the future trading and currency market, so you can place the trading whenever you deem necessary.

Key takeaways:

Forex trading is a vast market where currency is traded on a daily basis. If you know what and when to do then your chances of gaining profits increases at god’s speed. But, keep in mind that every time the gut feeling may not help you, so always keep a second option handy.

For this, use the pip value calculator. It is just like any normal calculator, but it gives you the exact number of profit or loss you would make when you see/buy the foreign currency.

Even if you are experienced, this tool will always benefit you. It is free, easy to use and is well known among all traders and brokers so you can actually get a second opinion of what exactly you trade.

So, leave the fears aside and start using the pip value calculator.