Implementation of GST was an iconic move by the Government to bring the whole nation under “one nation, one tax” policy. There have been ups and downs with GST since its implementation. There have been frequent changes to the GST rate in India on different goods and services. It is perhaps the second most significant move by the recent Government after demonetization that has had its impact on the economy. To understand the GST impact on the economy, it is important to understand the structure of GST.

Structure of GST

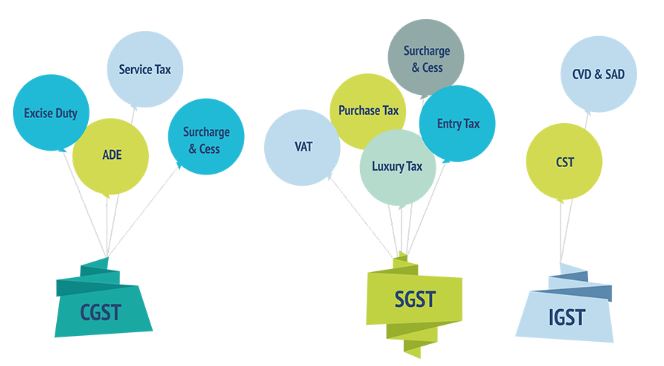

GST is categorized into 4 types. State Goods and Services Tax (SGST), Central Goods and Services Tax (CGST), Integrated Goods and Services Tax (IGST), and Union Territory Goods and Services Tax (UTGST).

- CGST – Central Goods and Services Tax.

CGST is governed by the Government under the Central Goods and Services Tax Act. Central Government levies CGST on the intra-state supply of Goods and Services. CGST successfully replaced all the previous taxes that were levied by Central Government such as Central Excise Duty, Central Sales Tax, Special Additional Duty Tax, Customs Duty, etc. CGST is levied on taxpayers, along with SGST. The revenue collected through CGST is remitted to the Central Government, and usually, CGST is levied the same as the SGST rate though it may vary from state to state.

- SGST – State Goods and Services Tax.

SGST is a tax levied on sales within a state. The state government levies the SGST. This tax replaces all the earlier taxes, such as Value Added Tax (VAT), Entertainment Tax, State Sales Tax, State Sales Tax, Entry Tax, cesses, and surcharges. The revenue collected through SGST is remitted to the State Government.

- IGST – Integrated Goods and Services Tax.

The Central Government accrues IGST and distributes it among states. IGST is levied on inter-state transactions of Goods and Services. It is also charged on imports. IGST is charged when suppliers transfer Goods from one state to another. The tax was implemented to simplify the process where each state had to deal with many different states. With the implementation of IGST, states will only have to deal with the Central Government.

- Union Territory Goods and Services Tax.

UTGST is a tax levied on the supply of Goods and Services in any Union Territory like Daman and Diu, Lakshadweep, Andaman and Nicobar Islands, Chandigarh.

GST rates:

The Government has suggested a 5-tier tax structure for Goods and Services with the Tax slabs 0.25%, 5%, 12%, 18%, and 28%. There are few commodities that do not attract any tax.

Since the implementation of GST in 2017, GST was taxed under a 4-tier tax structure. After 37th GST Council Meeting, a 5th tier was suggested, which would attract a 0.25% tax. Semi-polished and Cut stones were added to this tier along with few other products.

Goods that come under 0% tax (No tax) structure:

- Some goods were kept under the high tax bracket of 18% to 28%, but after scrutinizing the list, GST council found that few items should be considered as a necessity and not a luxury and hence a new list was created for Goods that come under 0% tax or No tax structure. Goods such as chicken, fish, eggs, milk, butter, milk, flour, besan, curd, fresh fruits and vegetables, natural honey, bread, prasad, salt, jute were previously under no tax structure. With the revised list of goods such as Sanitary Napkins, grains like barley, wheat, oat, etc., Palmyra Jaggery, Picture books, coloring books, etc. were included in this structure.

Goods that come under 5% tax structure:

- Goods such as Cashew nuts, Biogas, Insulin, Marble, rubber, Coir mats, matting and floor covering, hearing aids, Natural cork come under this tax structure.

Goods that come under 12% tax structure:

- After the 11th June GST council meeting, few items were added to this list along with the previous items. Plastic beads, Diagnostics kits, Diesel Engines, Walkie-talkie, Ketchup, Menthol, peppermint, spoons, forks, fish knives, etc. were added to the list of 12% tax structure.

Goods that come under 18% tax structure:

- Among other existing items, the following items were added under this tax slab – Kajal pencil sticks, Dental wax, Aluminium foil, Set-top Box for TV, Computer monitors not exceeding 17 inches, Transformers, Industrial Electronics, Baby carriages, Bamboo furniture and few more its were added under this tax bracket.

Goods that come under 28% tax structure:

- Goods that can be considered as luxury were taxed under this structure. Items such as aerated drink, luxury goods, tobacco, lotteries, high-end cars come under this tax structure. No items were added to this tax structure in the 37th GST council meeting as the meeting was held to lower the tax rates of items based on the preferences of customers.

There have been a lot of Goods that were changed to different tax structures since the implementation of GST, and the rates for various goods and services are subject to change from time to time without any prior information.

Impact of GST on the Indian economy.

Since the implementation of GST in 2017, it has been widely criticized as a failure to deliver benefits that were expected from it. Creation of scale efficiencies, Integration of the Indian marketplace, and enhanced GDP were expected as the natural outcomes. There has been no systematic study yet about the first two, but GDP growth has fallen since the past few years. To understand the impact, we should dive deep into the facts and figures to get an accurate understanding.

The Arvind Subramaniam committee indicated a revenue-neutral GST rate at 15%. At the time when the new tax was introduced in 2017, the rate was at 14.4%. After that, over the next two years, it came down to around 11.6%. There has been slower growth in GST revenues. The reduction in rates, exemptions granted to several businesses, the composition scheme made available to smaller businesses, and weaker economic activity overall is said to be the contributor to the slow growth in GST revenues.

There has been a lot of flak Central government has been facing from over the delay in the release of GST compensation to the states. The Government released Rs. 35,298 crore to the states as GST compensation on 16th December 2019.

The reason for the delay was said to the shortfall in GST collection by the central Government. There is skepticism about GST impact on the economy. With the revised GST rate in India over some goods and services and changes in the policies are expected to bring out the desired results.

For now, it shows that there have been some negative impacts on the service sector because of GST, and there have been some positive impacts on the collection of taxes through the supply chain of Goods. It basically depends on which side of the coin you want to choose. Though the overall impact of GST seems to be not as good as was expected earlier, the future holds a great promise.