A significant driver of the surge in external debt payments was the maturity of a $2 billion Eurobond (valued at Kes.260 billion at the current exchange rate). This debt matured in the first half of the 2023-24 fiscal year, straining the country’s fiscal position and raising concerns over a potential default.

The National Treasury’s new report on public debt revealed that external debt servicing nearly doubled jumping from Kes.402.4 billion to Kes.756 billion, representing more than three times the growth rate of the previous year.

By comparison, in the 2022-23 fiscal year, external debt servicing increased by only Kes.96 billion.

The report also shows that the government spent Kes.807 billion on domestic debt servicing, bringing Kenya’s total public debt to Kes.10.6 trillion.

Although external debt servicing increased by Kes.354 billion, domestic debt payments rose by just Kes.10 billion over the same period. Despite the slower growth in domestic debt, the steady increase has become a mounting concern for the government.

Domestic debt now accounts for 51 percent of Kenya’s total public debt, up from 47 percent in the 2022-23 fiscal year, while the share of external debt has decreased from 53 percent to 49 percent. This shift indicates the government’s rising reliance on local borrowing to meet its financial obligations.

Additionally, domestic interest payments make up 74 percent of all interest paid on public debt, a slight drop from 77 percent the previous year. The report revealed that the government borrowed nearly Kes.580 billion from the local market in the financial year ending June 2024.

A report presented to the National Assembly indicated that Kenya’s domestic debt stock rose to Kes.5.4 trillion by the end of June 2024, reflecting a Kes.578 billion, or 12 percent, increase from Kes.4.8 trillion at the end of June 2023. This rise is largely attributed to an increase in Treasury bonds, which the government used to meet its financing needs.

Treasury bond stock climbed from Kes.4.0 trillion in June 2023 to Kes.4.6 trillion in June 2024, while Treasury bills grew slightly from Kes.614.7 billion to Kes.615.9 billion during the same period.

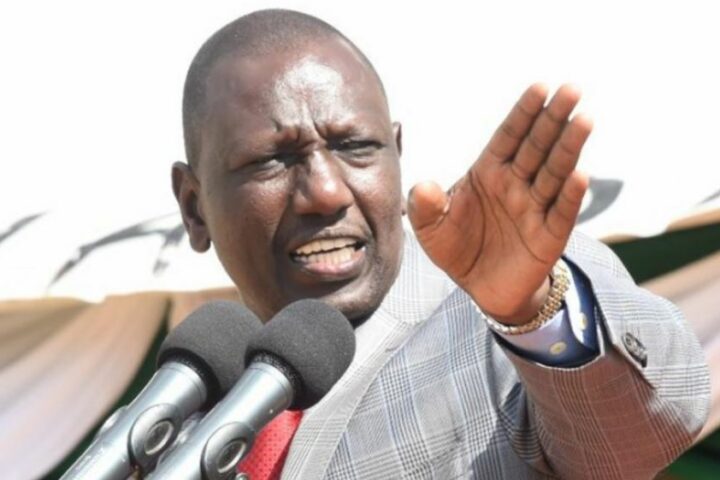

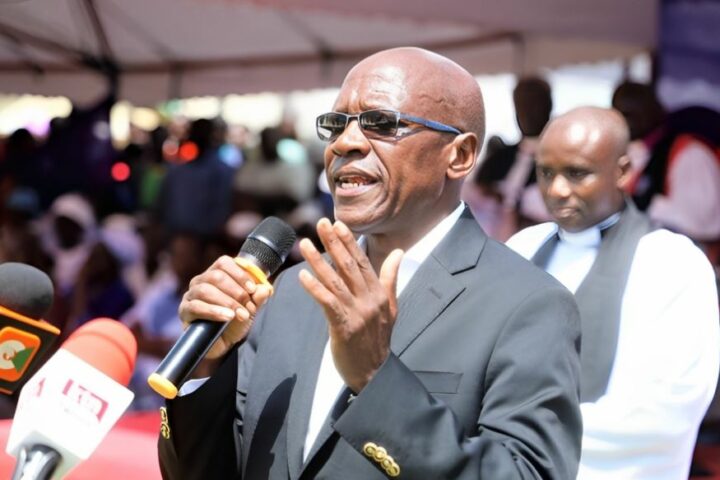

Speaking at the report’s launch, National Treasury Principal Secretary Chris Kiptoo highlighted that Kes.1 trillion has been allocated for public debt servicing in the current financial year, with Kes.750 billion set aside for domestic debt.

Kiptoo expressed confidence that the Central Bank of Kenya’s ongoing reforms in the foreign exchange market and efforts to manage interest rates in response to easing inflation would help reduce the government’s debt servicing costs.

“For external debt payments, a stronger shilling means we will spend fewer shillings per dollar, and we hope the Kes.260 billion budgeted for external debt servicing will be lower,” Kiptoo said. He added that anticipated lower interest rates could also lead to savings on domestic debt payments.

Kiptoo cautioned about the growing burden of debt servicing on national revenues. “When we receive revenue from the Kenya Revenue Authority (KRA), nearly Kes.7 out of every Kes.10 goes to debt repayment. This trend has been growing,” he noted.

“If we don’t slow down debt accumulation, we’ll end up collecting taxes primarily to pay off debt, particularly interest.”

The Treasury’s report also showed that Kenyans paid Kes.1.6 trillion to service public debt in the 2023-24 financial year, up from Kes.1.2 trillion the previous year. Of this amount, Kes.840 billion went toward interest payments, while the rest was allocated to principal repayments.

Interest payments on domestic debt reached Kes.622.5 billion, while interest on external debt amounted to Kes.218.2 billion.

Total debt servicing as a share of ordinary revenue rose to 68.3 percent in 2023-24, compared to 58.8 percent in the 2022-23 financial year, underscoring the pressure that debt servicing is placing on the country’s finances.