The number of loan defaulters in Kenya has nearly doubled over the past year, with 3.85 million more borrowers blacklisted by various lenders, primarily digital lending platforms and mobile loan apps.

The number of loan defaulters in Kenya has nearly doubled over the past year, with 3.85 million more borrowers blacklisted by various lenders, primarily digital lending platforms and mobile loan apps.

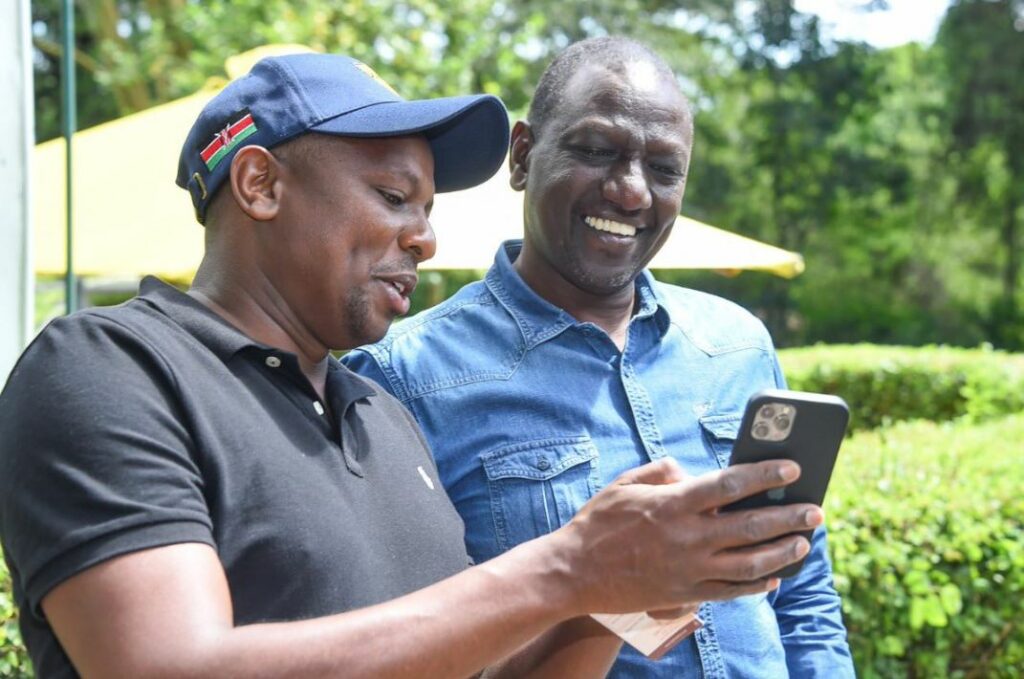

This surge highlights the challenges of President William Ruto’s intervention, which aimed to repair the credit scores of over 4.2 million Kenyans in the last year.

According to a new report by TransUnion Africa, a credit reference bureau, the number of Kenyans negatively listed by various credit reference bureaus (CRBs) reached 7.74 million in the first quarter of this year. This marks a staggering 99.2 percent increase from the 3.89 million borrowers listed as defaulters in the same quarter of 2023.

TransUnion noted that negative listings had previously declined due to the Central Bank-backed credit repair framework implemented between the first and fourth quarters of 2023. However, the current situation has reversed that trend.

Among those affected by high default rates are borrowers from Ruto’s flagship initiative, the Hustler Fund, which provides loans to individuals and small businesses. More than 13 million borrowers have defaulted on a total of Kes. 7 billion.

The credit repair framework targeted about 4.2 million borrowers utilizing digital platforms offering loan terms of 30 days or less. This initiative included loans from commercial banks, microfinance institutions, and mortgage finance banks regulated by the Central Bank of Kenya (CBK).

At that time, these loans amounted to Kes. 30 billion, representing 0.8 percent of the gross banking sector loan portfolio of Kes. 3.6 trillion as of October 2022.

In 2023, the 4.2 million borrowers classified as defaulters saw their credit status improve from non-performing to performing after the CBK directed lenders to offer at least a 50 percent discount on outstanding loans and to extend repayment periods.