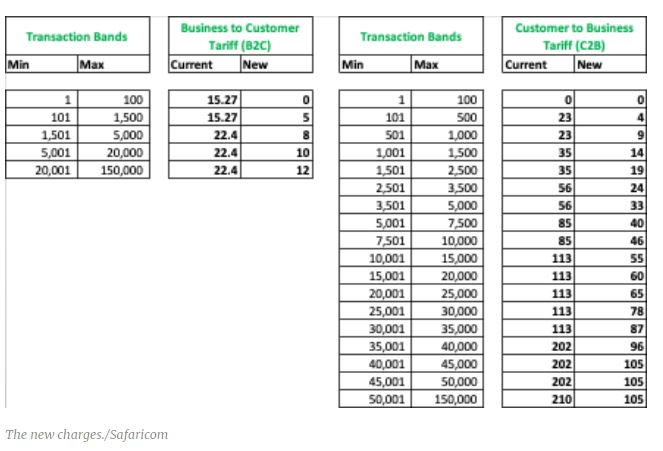

The giant telco has reduced M-Pesa paybill charges, M-PESA to Bank, and Bank to M-Pesa tariffs in an effort to cushion customers from the prevailing economic challenges.

Bank to M-Pesa transactions will drop by an average of 61 per cent while M-PESA to Bank charges have been reduced by an average of 47 per cent.

Transactions below Sh 100 remain zero-rated.

The new tariffs apply to all M-PESA Paybill payments that customers use for utilities such as electricity, hospital bills, schools, government payments etc.

“In our role to continue supporting the economy and stimulating growth, we have taken the initiative to reduce significantly our paybill and business to customer tariffs,” Safaricom CEO Peter Ndegwa said.

“This move reaffirms our commitment to support all our customers and enable them cost effectively get along with their lives especially at this time when most Kenyans are experiencing hard economic times,” he said.

“The revised tariffs have been structured to ensure alignment with the Central Bank of Kenya pricing principles on customer centricity; transparency and disclosure; fairness and equity; choice and competition as well as affordability.”

Here are the new Safaricom M-Pesa charges.