It begins with a sharp rise in a stock’s price, known as the flagpole, followed by a consolidation phase where the price moves sideways or slightly downward, forming the flag.

This pattern offers traders valuable insights for making informed market decisions. Unlock your trading potential with Immediate Frontier, where experienced educational experts bridge the gap between novice and skilled traders.

Explanation of Bull Flag Formation

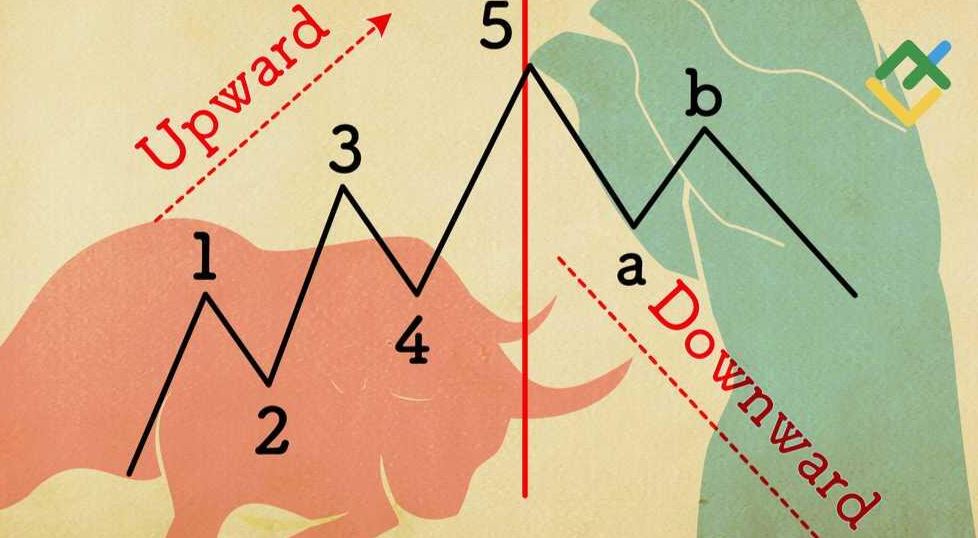

The bull flag formation is a key pattern in technical analysis that suggests a continuation of an upward trend. Imagine a steep climb in a stock’s price, like a sprinter taking off at the start of a race. This initial surge is known as the flagpole.

After this rapid rise, the stock price enters a consolidation phase, moving sideways or slightly downwards. This part is the flag. It’s like the runner catching their breath before the next burst of speed.

During the consolidation, the price movement creates a small rectangle or parallelogram.

Traders often see this as a temporary pause before the stock continues its upward momentum. The formation ends when the price breaks out of this pattern, resuming its climb.

This breakout is often accompanied by high trading volume, signaling strong investor confidence.

So why is this pattern important? It offers traders a visual cue that the upward trend is likely to continue, providing an opportunity to enter the market before the next surge. Picture it as a brief pit stop in a race where the driver refuels before speeding ahead again.

This predictable behavior helps traders make informed decisions, increasing their chances of success.

Key Characteristics and Features of Bull Flags

Bull flags have distinct features that make them recognizable.

The first is the flagpole, which is a sharp and significant rise in the stock’s price. This surge is usually due to positive news or strong buying interest. Following the flagpole, the stock enters a consolidation phase.

Here, the price moves sideways or slightly downwards, forming the flag. This period of rest is marked by lower trading volume compared to the flagpole, indicating that traders are pausing before the next move.

Another key characteristic is the duration of the flag formation.

This consolidation phase is typically short, lasting from a few days to a few weeks. The shorter the flag, the stronger the signal of a continued upward trend. However, if the flag lasts too long, it may indicate a weakening trend or a shift in market sentiment.

The breakout from the flag is another important feature.

When the stock price moves out of the flag formation, it usually does so with increased volume. This surge in trading activity confirms the pattern and signals to traders that the upward trend is resuming.

Think of it like a rocket ship refueling before taking off again. Recognizing these features can help traders spot bull flags and make timely trading decisions.

Anatomy of a Bull Flag

Understanding the anatomy of a bull flag helps in identifying and leveraging this pattern. The flagpole is the first element to observe. It represents a sharp increase in the stock’s price, driven by strong buying interest.

This rise is often steep and rapid, capturing the market’s attention. Next comes the flag, which is the consolidation phase. During this period, the price moves within a narrow range, forming a rectangle or parallelogram.

The flag can tilt slightly downwards or move horizontally, but it should not retrace more than 50% of the flagpole’s height.

The key part of the bull flag’s anatomy is the breakout. When the price breaks out of the flag, it typically does so with increased volume. This breakout signals the continuation of the upward trend. It’s like a sprinter who has caught their breath and is ready to dash forward again.

Traders watch for this breakout to confirm the pattern and to decide their entry points.

The context of the broader market also matters. A bull flag within a strong uptrend is a powerful signal. However, if the broader market is uncertain or bearish, the bull flag might be less reliable. Imagine trying to run uphill versus on a flat track.

Recognizing the parts of a bull flag and understanding their implications can enhance a trader’s ability to predict market movements and make profitable trades.

Conclusion

Recognizing and understanding the bull flag formation can significantly enhance a trader’s ability to predict market movements and capitalize on upward trends.

The combination of the flagpole, consolidation phase, and breakout provides clear visual cues that help traders identify potential opportunities for profitable trades, ensuring they stay ahead in the competitive market landscape.