Many traders stumble upon common mistakes, turning potential gains into losses. Are you ready to uncover these pitfalls and sharpen your trading skills? Let’s dive into the key missteps and how to avoid them.

Discover how immediate-mentax.org/ connects traders with top educational experts, helping you navigate the complexities of Elliott Wave Theory effectively.

Misinterpretation of Wave Patterns

Understanding wave patterns in trading can sometimes feel like trying to read tea leaves. Traders often mistake market noise for genuine wave patterns. Picture this: you’re surfing, but instead of catching a perfect wave, you end up paddling on a ripple.

That’s what misreading wave patterns can be like.

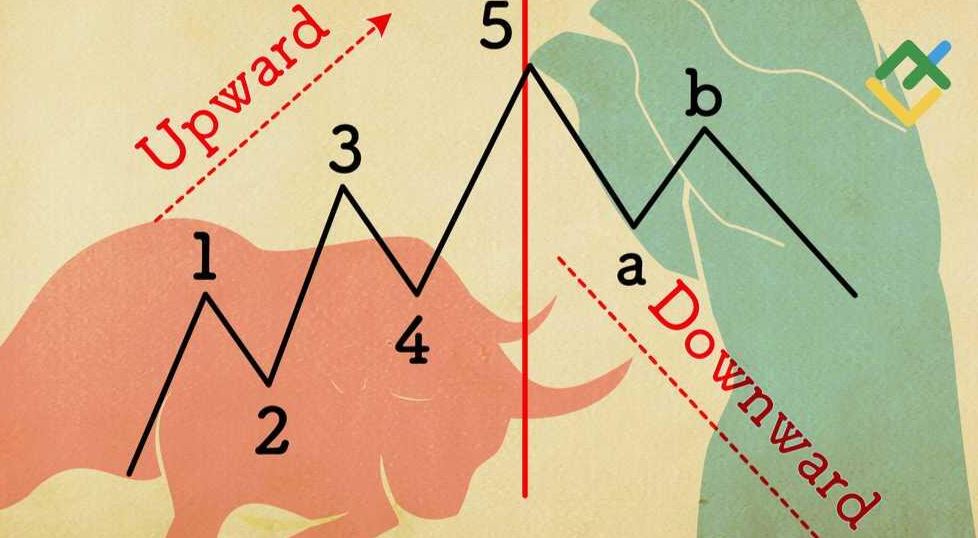

For instance, distinguishing between impulse and corrective waves is crucial. Impulse waves are like strong, driving forces in the market, whereas corrective waves are the market taking a breather.

A common blunder is counting waves incorrectly. Imagine you’re baking a cake and you miscount the eggs – the result won’t be what you expected. Similarly, miscounting waves can lead to poor trading decisions.

Traders might jump the gun, thinking a wave has completed when it hasn’t, leading to premature trades. Or they might hold back, missing opportunities because they’re waiting for a wave that’s already passed.

To avoid this, always double-check your wave counts. Use multiple time frames to confirm your analysis.

Keep in mind that the market isn’t always straightforward – it’s like a dance, and you need to be in sync.

Remember, practice makes perfect, and learning from mistakes is part of the journey. It’s also helpful to discuss your wave counts with fellow traders or mentors to gain different perspectives.

Overcomplicating Wave Structures

Traders sometimes get lost in the details of Elliott Wave Theory. It’s like trying to navigate through a dense forest without a map. When you overcomplicate wave structures, you risk missing the big picture.

Imagine you’re assembling a puzzle, but you’re so focused on one piece that you forget to see how it fits into the whole.

Take this scenario: a trader spends hours analyzing a single wave, breaking it down into sub-waves and sub-sub-waves. They end up with a tangled web of data that’s hard to interpret. This over-analysis can lead to analysis paralysis, where you’re unable to make a trading decision because you’re overwhelmed by information.

The solution? Keep it simple. Start with the basic wave patterns and confirm your analysis with other indicators. Focus on the major waves that are most obvious. This approach not only saves time but also makes your trading strategy more effective.

Remember, even seasoned traders aim for clarity and simplicity in their analyses.

Here’s a tip: think of Elliott Wave Theory as a roadmap, not a set of instructions for building a rocket. Use it to guide your trading decisions, but don’t get bogged down by every tiny fluctuation in the market. When in doubt, take a step back and reassess the overall trend.

Simplifying your approach can lead to better, more confident trading decisions.

Ignoring Wave Theory Guidelines

Wave Theory has some rules that traders often overlook. Ignoring these guidelines can be like ignoring traffic lights – it might seem fine until an accident happens.

For instance, one rule is that wave three is never the shortest among waves one, three, and five. Overlooking this can lead to incorrect wave counts and bad trades.

Imagine you’re playing chess, and you forget the rules about how the pieces move. Your game strategy would fall apart quickly.

Similarly, ignoring the principles of Wave Theory can derail your trading strategy. Another key guideline is that wave two never retraces more than 100% of wave one.

This rule helps in correctly identifying the start and end of waves.

To avoid these mistakes, familiarize yourself with the basic rules of Wave Theory. Keep a checklist handy when analyzing wave patterns. Think of these guidelines as your trading guardrails – they keep you on track and help prevent costly errors.

Regularly reviewing these rules can improve your accuracy. Discuss your wave counts and interpretations with other traders or mentors. They can provide valuable insights and catch mistakes you might have missed. Remember, even the most experienced traders benefit from sticking to the basics.

Consistency in following these guidelines can enhance your trading success and confidence.

Over Reliance on Elliott Wave Theory Alone

Depending solely on Elliott Wave Theory is like driving a car with only one headlight. It might work sometimes, but you’re bound to miss critical details.

Traders often make the mistake of using Wave Theory in isolation, ignoring other valuable tools and indicators. This overreliance can lead to missed opportunities and increased risks.

Imagine you’re cooking a complex dish using only one spice. The result might be okay, but it won’t have the depth and richness of flavor that comes from using a variety of seasonings.

Similarly, Wave Theory is powerful but should be complemented with other analyses like trend lines, moving averages, and volume indicators.

Here’s a real-world example: a trader spots a potential impulse wave and decides to invest heavily based on that analysis alone. Without confirming this signal with other indicators, they’re taking a significant risk. If the wave doesn’t unfold as expected, the losses can be substantial.

Diversify your analysis methods. Use Elliott Wave Theory as one part of a broader strategy. Cross-reference your wave analysis with other tools to get a fuller picture of market conditions. This multi-faceted approach can help you make more informed decisions.

Conclusion

Mastering Elliott Wave Theory is a journey, not a destination.

By sidestepping common mistakes and refining your strategies, you can transform your trading game. Remember, continual learning and adaptation are your best allies in the ever-shifting market landscape.

Keep honing your skills and stay ahead of the curve!