What is Kenya’s economic status?

Kenya stands at the crossroads of growth and failure. Examining the economy, it is evident that Kenya is facing critical challenges that may undermine any prospects of better growth. These challenges include high levels of poverty, with approximately 43 per cent of Kenyans living below the national poverty line, and significant inequality, with the richest 10 per cent controlling about 40 per cent of the country’s wealth.

Corruption poses a major obstacle to economic growth, and climate change threatens Kenya’s agricultural sector. Additionally, high unemployment rate remains a contentious issue between the government and the opposition, along with high cost of living, which has fuelled opposition protests. The signing of the Finance Bill 2023 by the president creates a sense of unease within the business community. On a scale of 1 to 10, I would rate our current course towards economic growth at 3/10.

Talk about the signed housing levy in the Finance Act 2023; what are the notable implications?

There are several. First, it would impose an increased financial burden on Kenyans through the implementation of a 3 per cent housing levy, leading to a significant rise in the cost of living. Second, the housing levy would reduce disposable income, limiting the amount of money available for expenditure on other goods and services. Furthermore, the Bill would require substantial government spending to establish the National Housing Development Fund (NHDF) and the National Housing Authority (NHA), contrary to calls for reduced government expenditure.

Do you think housing should be the main issue given the economic status of the country?

Housing is an important issue, and the Constitution stipulates that every Kenyan is entitled to better housing. However, it is not the role of the Kenyan government to directly provide homes for its citizens. Kenya operates as a capitalist state, not a socialist one. Instead, the government’s responsibility lies in creating an enabling environment for Kenyans to secure sustainable jobs that would allow them to afford better housing. There are more pressing matters that demand the government’s attention, such as addressing the challenges within the National Health Insurance Fund (NHIF), ensuring adequate funding for schools and counties, combating crime and corruption, and promoting a conducive manufacturing environment.

Right now everything seems to be pegged on tax, what are the implications?

The government’s heavy reliance on taxes to generate revenue and fund development projects will have various implications for businesses and individuals.

These implications include: Increased costs: Higher taxes have compelled businesses to pass the burden to consumers, resulting in higher prices. Reduced investment: Businesses will be hesitant to invest in a country where they anticipate having to pay substantial taxes, resulting in slower economic growth.

Reduced disposable income: This limits their ability to save, invest, and spend, leading to decreased consumer spending. Increased corruption: The need to circumvent the high tax rates will contribute to increased corruption, as individuals seek ways to evade the system and retain more money. Increasing unemployment: With taxes levied on various aspects, job opportunities will diminish, leading to rising unemployment rates creating a ripple effect throughout the economy.

Are there other ways the government can apply without hurting Kenyans’ pockets?

The government has been hesitant to implement alternative strategies for revenue generation, despite potential solutions that could alleviate the burden on Kenyans. To enhance revenue collection, the following measures could be considered: Reduced fuel costs would lower energy expenses and transportation costs, leading to increased business opportunities, job creation, and subsequent tax contributions.

Restructuring the government’s debt portfolio to create a more favourable environment for businesses to thrive and grow and implementing a zero-rated tax policy for farming inputs, which will provide a much-needed boost to the agricultural sector and facilitate its industrialization.

Are there things we can do right now to cope with the tough economy?

When times are tough and challenging, it becomes necessary to prepare ourselves to face the difficulties ahead.

Here are some ways to navigate such situations: Prioritise spending on critical and important matters only. Obtain affordable health insurance coverage to safeguard against medical expenses.

Consider seeking remote job opportunities to supplement limited resources. Engage in side hustles that do not interfere with your main job.

Utilise any available land back home to grow your own food, thereby saving money for investments and allowing your money to work for you.

Explore the possibility of cost-sharing with someone else to enhance savings. This can be achieved through finding the right partner/spouse.

Lastly, what can you advise the president and his entire team?

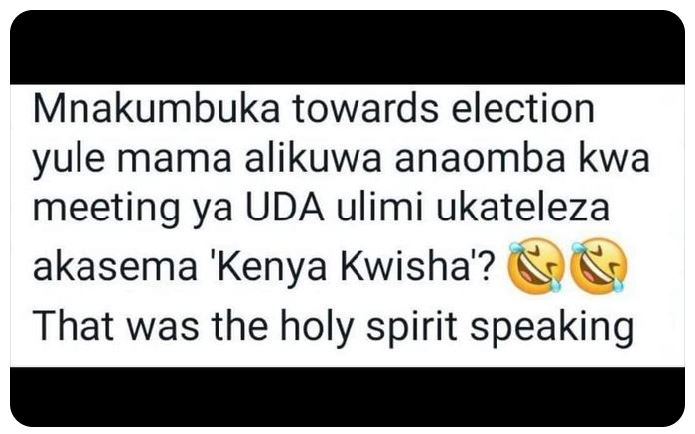

Unfortunately, they do not listen to anyone except their own interests, personal gain, and their associates. However, if they were to listen, here are some suggestions: Take responsibility for the economic situation. Uphold all promises made during the campaign period. Cease the “Us vs Them” rhetoric; Tackle corruption alongside efforts to promote the housing fund; Respect the law, accept all court rulings, and honour the Constitution by adhering to its principles; Respect the separation of powers among the three branches of government. Ensure that the deputy president refrains from speaking to the media for at least a year.

Embrace all Kenyans as one united nation.

Courtesy: The Nairobian