When in need of a loan to start a small business, maintain your cash flow or fund your next stage of growth, then getting an unsecured loan might be the best option for you.

Loans without security do not need collateral as security but a good credit score and a statement that depicts a reasonable amount of transactions in your account. Collateral is an asset such as a car or a title deed that a lender may sell to recoup the losses in case you default on the loan. Where can I get unsecured loans in Kenya?

Where to get loans without security in Kenya

Here is the list of the best financial institutions where you can get unsecured loans in Kenya now:

1. MPOWER Financing

MPOWER Financing is a financial corporation that provides unsecured loans of up to Ksh1 million to international students. If you applied and get a calling letter from international institutions such as in the US or Canada, you are legible to apply.

Although the funds are wired directly to the school account, you can request a withdrawal for school education-related expenses, including but not limited to tuition, books, meal plans, housing, and health insurance.

Although it has an organisation fee, it is not paid upfront but during the 10-year repayment period.

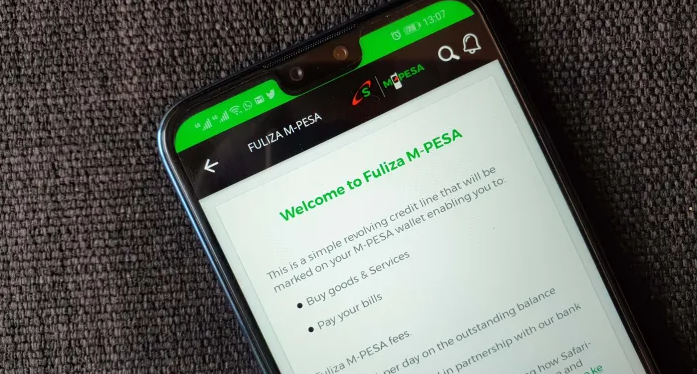

2. Fuliza Mpesa

Safaricom Fuliza Mpesa is an overdraft credit facility that was incepted in 2019 through KCB and NCBA Bank partnerships. It allows customers to transact even when they are low on funds.

Fuliza Mpesa can be accessed by dialling USSD *234# or on Mpesa app, and one can borrow up to Ksh70,000 unsecured loan. It has a processing fee of 1%, and one is supposed to pay the daily administrative fee within a month.

3. KCB Mpesa

KCB Mpesa is a product by Safaricom and Kenya Commerical Bank (KCB). Qualifying for a loan with KCB Mpesa does not necessarily mean you are a KCB Bank customer but a frequent Mpesa user.

It gives loans without security from as low as Ksh50 to Ksh1 million with an interest rate of 7.5% a month and a flexible repayment period of 30 days. The advantage is that you can borrow many times within your limit.

4. Branch Loan app

Branch Loan app is one of the most popular and used loan apps in Kenya that was started by a US company Branch International Inc (BI), in 2015. It offers affordable loans of Ksh250 to Ksh100,000 with a repayment period of 4-52 weeks and an average monthly rate of 1.7% – 17.6%.

The Branch Loan app is available for free download on Google Play Store and Apple Store.

5. Zenka Loan app

Zenka Loan app has created a name in the microfinance industry as the fastest dispatcher of unsecured emergency loans. Within minutes of Zenka app installation and registration, one can get a loan of Ksh500 to Ksh45,000 repayable within 61 days.

The first loan is interest-free, but one has to pay a processing fee of 9-39% on the principal amount.

6. Saida Loan app

Saida Loan app helps you get an instant loan without security directly to your Mpesa or Airtel Money. However, you must have a good transaction history to qualify for any loan from Ksh100 to Ksh50,000.

7. OKash Loan app

OKash has been operational since 2018, offering Kenyans affordable loans with no single documentation. To qualify, you must be an active Mpesa user aged between 20 and 55 years.

OKash gives loans of up to Ksh500,000 with a repayment period of 365 days and a rate of 36% per annum.

Now read: How To Get a Quick Mobile Loan in Kenya