The Digital Service Tax in Kenya is the tax payable from the proceeds of services offered in an online marketplace where buyers pay for goods and services electronically via; credit cards, debit cards, virtual cards, and ACH (direct deposit, direct debit, and electronic checks).

It was introduced through the Finance Act 2020 and was effected on January 1, 2021, as a move to shore up revenue shortfalls.

DST applies to goods sold via websites or social media, and persons involved in the online business should declare their income and file DST returns with the Kenya Revenue Authority (KRA). Digital Service Tax is paid in Kenyan shillings.

Who pays Digital Service Tax?

Residents and non-residents with an online marketplace or are digital service providers pay the Digital Service Tax (DST).

Residents are individuals with permanent residence in the country, while non-residents are individuals with no permanent home in Kenya but have been in the country for more than 183 days in a particular income year or 122 days in the year of income under review and two other preceding years.

Companies that also have their management in Kenya and those registered under Kenyan laws are also subject to Digital Service Tax.

How much is the Digital Service Tax?

Digital Service Tax (DST) rate is 1.5% of the gross transaction value exclusive of Value Added Tax (VAT). The total transaction value includes money paid for the services by the user and the commission earned by using a digital service.

What is the due date for Digital Service Tax?

Digital Service Tax (DST) is due every month. Individuals and companies should file DST returns before or on the 20th of the month preceding the day the digital service was offered.

How to pay Digital Service Tax in Kenya

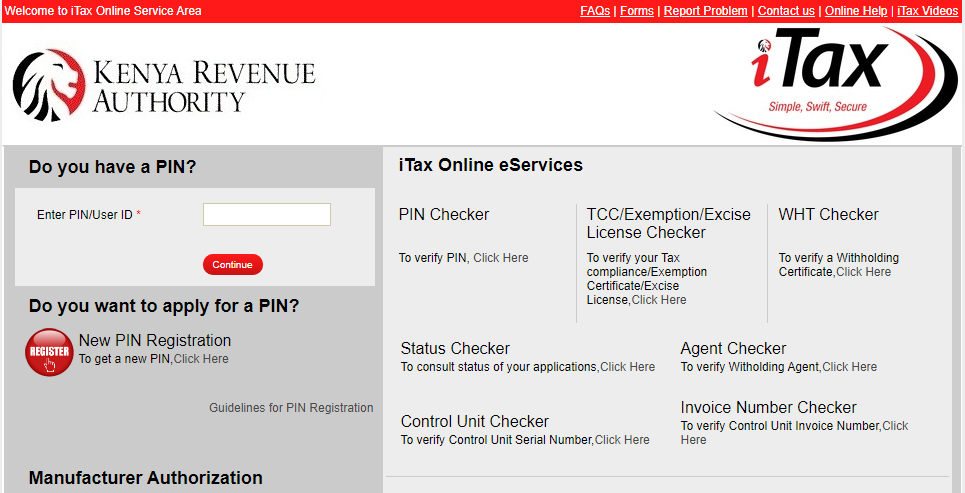

1. Visit https://itax.kra.go.ke/KRA-Portal/ and log in with your KRA PIN and password

2. On the landing page, select ‘Payment Registration’

3. Click ‘Next’ to proceed

4. An e-registration form will pop up. Select ‘Income Tax ‘ in the Tax Head and ‘Digital Service Tax’ in the Tax Sub Head

5. Choose the payment methods in your platform, month, and income year

6. Enter your transaction value and the mode of payment you will use to pay the Digital Service Tax

7. Click ‘Submit’ and proceed to pay the DST in your selected payment method

8. Confirm your details and the transaction

Done! That is how to pay your Digital Service Tax online.

Is Digital Service Tax a final tax in Kenya?

Digital Service Tax is only a final tax for non-residents with no permanent home in Kenya. For residents, DST is considered an advance tax by Kenya Revenue Authority (KRA), and individuals or business entities will deduct paid DST at the end of every year when filing annual Income Taxes.

Digital Service Tax is not subject to deductions after payments of Withholding Tax (WHT).

Now read: How To Check KRA Registration and Tax Payment Status