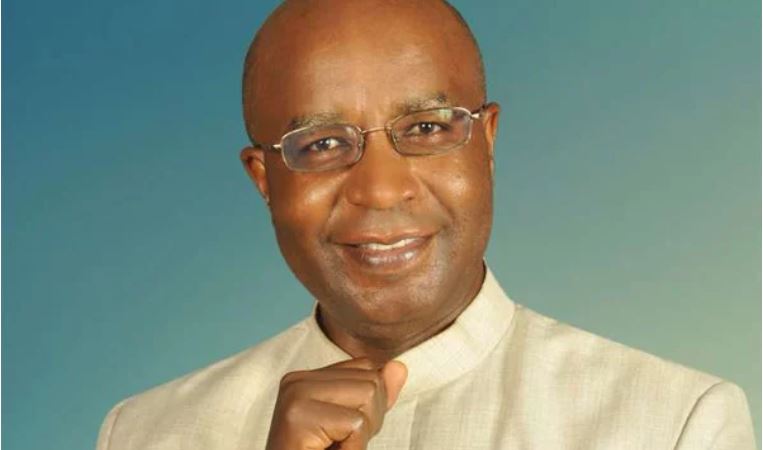

He spoke to myNetwork about the five financial principals every budding entrepreneur should possess and everything finances.

What valuable lessons can young people draw from your 25-year career in the financial sector?

Patience and persistence. One must also have the humility to start very small, work diligently, professionally and loyally to reach the top. Career life is a process, there are no short-cuts to a place worth going to. Money is not everything. Fulfillment from a job well done and lives transformed is the best demonstration of duty to humanity, and the best enduring legacy. Integrity is your true north. There is no reward, monetary or otherwise, that should dent your character. Always stand up for something.

You interact with young people a lot. What do you appreciate most about them?

I appreciate their desire to thrive in business and their appetite for information to help them make the right investment decisions. The youth appreciate the leverage power of pooling resources in pursuit of a common purpose. Unlike the conservative older generation, they are more inclined to try out new financial products, which is good for our financial market.

What five financial principles should every budding entrepreneur possess?

Guard your money religiously through record keeping and internal controls. Endeavour to earn relevant basic skills in business management because ignorance is the number one killer of start-ups. Whereas risks cannot be eliminated, they can be mitigated, therefore be proactive in identifying the inherent risks in your chosen line of business. You can’t grow a sustainable business purely from your own funds. Debt finance is a very good leverage that enables an investor to achieve bigger dreams faster. Learn to use other people’s money by borrowing loans. Most importantly, work with individuals with the right attitude, people who can make the right decisions for better results.

What was your experience like heading Women Enterprise Fund, a women-focused organisation?

Initially, some had questioned the wisdom behind contracting a man to head a women affirmative action fund. But my response was simple: progress means promoting women’s interests without discriminating against men. It was a satisfying experience working with Kenyan women, especially because some who had never borrowed money were eventually able to access collateral and interest-free loans to start businesses. With a 92 per cent repayment rate, we proved that without political interference and with persons of integrity in charge, government-lending programmes can succeed.

Tell us about your latest book.

The book, 52 Weekly Powerful Conversations, is my first title, which I wrote in 2014. The thrust of the message is to transform individuals and teams to unleash their potential in their quest to attain personal and collective organisational goals. During my time at WEF, I discovered how difficult constructive communication is in large organisations because of the bulk of information involved. Weekly communication resulted in 52 different conversations per year. My colleagues advised me to package the conversations in book format, hence the title.

There are so many financial literacy books in the market. Why hasn’t this translated to wiser investment decisions among budding entrepreneurs?

Information is only ‘potential power’. You may read all finance literature in books and on the Internet, but how you use that information ultimately makes the difference between success and failure. The youth should employ such information to become more efficient and effective in creating solutions needed by the market. Lack of humility to seek information from the right people leads to poor investment decisions, while lack of patience makes the youth easy prey to quack advisors and fraudulent quick money scams. Blatant disregard of the principle of the process is also dangerous.

What sort of books do you read?

I read fiction, motivational, autobiographies, psychology and finance-related books. I’m currently reading, What Money Can’t Buy, by Michael J. Sandel and 50 Ways to Wealth, by John Lowe.

How can Kenya’s youth keep positive energy amid the worsening state of unemployment and poor governance in Kenya?

The youth are an integral component of our political and socioeconomic spheres, and as such, they should focus their mental and physical energies by inventing practical solutions to our perennial challenges, for instance by revamping the rural economy in agriculture to enhance food security. They shouldn’t allow themselves to be used as pawns in the political chess game or to cause mayhem.

Women and the youth in Kenya lag behind economically despite intervention measures including funds established for them. How can this scenario be explained?

There has been little enthusiasm towards loans set up by the national and county governments. The free-things mentality is, sadly, deeply entrenched in our national psyche such that the targeted persons are disinclined to take loans because of the interests they attract. Enterprise development is about risk-taking, yet most Kenyans have a risk-averse predisposition. Corruption and bureaucracies also tend to scare people away from government programmes. Lastly, there’s a misplaced notion that every woman and young person has an entrepreneurial spirit.