Kenya Police Sacco was started in 1972 as a DT (deposit taking) Sacco. It first registered 690 members and has grown immensely to amass a membership of over 60,000.

The Sacco provides sustainable financial services to its members, who are mostly drawn from Kenya’s police force, as it provides a safe place of securing their deposits to drive them towards the timely realization of their financial goals as outlined in its mission – To provide competitive financial solutions to our members through effective mobilization and management of resources.

Who can join Kenya Police Sacco?

As depicted by its name ‘Kenya Police Sacco,’ many think that its membership is only reserved for the law enforcement officers but is Kenya Police Sacco only for police officers? No, its membership is open to any individual above the age of 18 years who meets their eligibility requirements.

What are the requirements for joining Kenya Police Sacco?

Everyone can join Kenya Police Sacco as long as you meet these conditions:

* Be in service or a retired member of any police wing in Kenya

* Be a civil servant or employed in the private sector with a salary

* Be a businessperson with certified legal businesses

* Be a child of any of the above with over 18 years of age

How to join Kenya Police Sacco

Joining Kenya Police Sacco is the first step towards your financial success as they provide affordable loans, salary advances, and saving with them will earn you the best interests in the capital markets. To become a member, follow these steps:

1. Download the membership application form here or simply register by visiting this link https://policesacco.com/become-a-member/

2. Fill out the application form with details such as name, address, employment information, and mode of remittance. Details should be completed with capital letters.

3. Attach two copies of your national ID (front and back) and two colored passport size photographs

4. Take the documents to the nearest Kenya Police Sacco branch for verification

5. You are now a member of Kenya Police Sacco

Members of Kenya Police Sacco are required to make monthly contributions equivalent to 12% of their basic salary. They are entitled to high annual dividends and interest on deposits and instant loans.

Kenya Police Sacco loans

Kenya Police Sacco offers loans to its members for investments in fields such as; agriculture, business, and real estate. But what are the requirements of getting a loan from Kenya Police Sacco?

* Completed loan application form available on their website https://policesacco.com/downloads/

* You must have guarantors – the number of guarantors depends on the loan amount, and they must be active members of Kenya Police Sacco

* Your application form must be verified and signed by any Kenya Police Sacco employee

* Two pay slips of the immediate two previous months and your ID card must be submitted with the loan application form

Additionally, you must provide security for your loans, and the qualifying amount depends on four times savings in the business account.

| Type of loan | Monthly interest rate | Repayment period | Security |

| Business loans | 1.25% | 24 months | Title deed/logbook |

| House/land purchase loans | 1.25% | 48 months | Title deed/logbook |

| Commercial vehicle loans | 1.25% | 36 months | Title Deed/Log Book/Members Deposits for groups |

| Agriculture loans | 1.25% | 12 months | Title Deed/Members Deposits. |

How can you deposit funds on Kenya Police Sacco?

The more the savings, the higher your loan limit. Also, the money saved may act as a cushion during emergencies, and it is also a method of building your wealth.

How can you make monthly contributions to Kenya Police Sacco? The Sacco can receive your deposits directly from the employer through check off. Additionally, you can make cash payments, submit a banker’s cheque or pay through Mpesa.

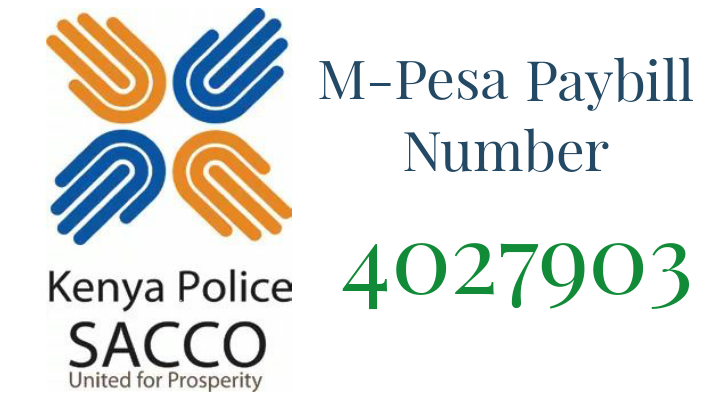

Here is how to deposit money to Kenya Police Sacco using Mpesa:

1. Go to Safaricom sim toolkit

2. Select Lipa na Mpesa

3. Enter Kenya Police Sacco pay bill number 4027903

4. Enter your Kenya Police Sacco account number as the account name

5. Enter the amount

6. Enter Mpesa PIN

7. Send

You have successfully deposited funds into your Kenya Police Sacco account.

How to withdraw money from Kenya Police Sacco to Mpesa

Mpesa is the most convenient mobile money service as it allows you to access your funds in cash from the numerous Mpesa outlets countrywide. It also grants you the ability to pay for services using Lipa na Mpesa or Buy Goods Till option when making different transactions such as shopping.

How can you transfer funds from Kenya Police Sacco to Mpesa? Here is an easy guide:

1. Register on M-TAWI by dialing *653#

2. Enter your account number

3. Follow the prompts to receive an OTP from Kenya Police Sacco

4. Check your inbox and note down the OTP

5. Dial *653# again

6. Enter the OTP and set a new PIN

7. Proceed to the ‘Withdraw’ option

8. Choose ‘Withdraw to Mpesa’

9. Enter the amount to withdraw

10. Confirm the transaction

You will receive Mpesa message confirming the transaction, and funds will be loaded in your mobile wallet.

Kenya Police Sacco contacts

HEADQUARTERS ‐ NAIROBI

Ngara Road, off Muranga Road, P.O. Box 51042 ‐ 00200, Nairobi

TEL: 0709 825 000

EMAIL – [email protected]

MOMBASA BRANCH

Jubilee arcade Moi Avenue near Pembe Za Ndovu

TEL: 0709 825 505

ELDORET BRANCH

Zion Mall, Ground Floor, Eldoret – Uganda Road, Opposite Kenol

TEL: 0709 825 530

KAKAMEGA BRANCH

Daaron Foundation Trust building, Ground floor, Off Mumias Rd opposite NALA Hospital

TEL: 0709825560

MERU BRANCH

Solco Plaza, Ground Floor, Moi Avenue

TEL: 0709 825 590

NYERI BRANCH

Kasturi Plaza, 1st Floor, Kimathi Street

TEL: 0709 825 570

KISII BRANCH

Mocha place, 2nd Floor, Opposite Tuskys

TEL: 0709 825 551

NAKURU BRANCH

SAILEE HSE on the GROUND FLOOR. Kenyatta Avenue opposite Nyayo Gardens

TEL: 0709825600

Kenya Police Sacco Facebook – Kenya National Police DT SACCO

Kenya Police Sacco Twitter – @Police_sacco