With this approach, beginners and busy traders can emulate the profits of seasoned investors, making it possible to make money without requiring a high level of skill.

It does, however, require thorough investigation and focus.

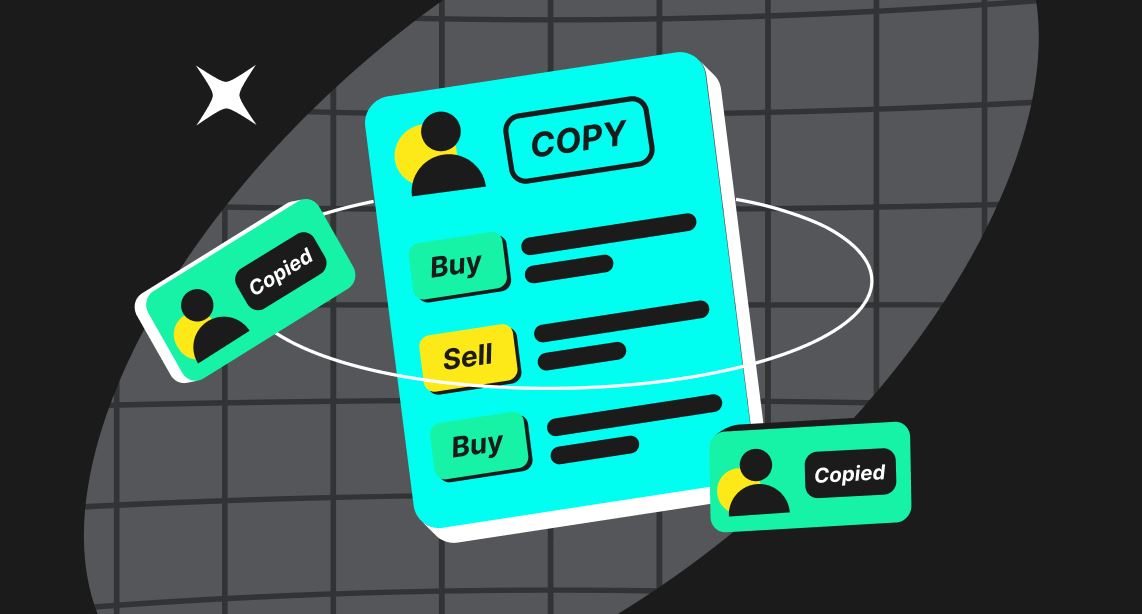

Understanding and Utilising Copy Trading

Without extensive knowledge of the market, novices might benefit by imitating the trading tactics of more seasoned traders through copy trading.

Investing decisions can be facilitated by the ability of users to duplicate and track trades in real time through specialised platforms.

Copy trading focuses on real-time deal replication, in contrast to social trading, where users engage with investors, and mirror trading, which automatically follows techniques.

This approach has developed over the years, from newsletters and online trading rooms to sophisticated systems like Mirror Trader, which gained popularity in the 2000s.

Even with more regulation following the 2008 financial crisis, by the 2010s, many brokers, particularly in the FX market, had integrated copy trading.

Copy trading can be carried out automatically, in which case the platform takes care of everything, or manually, in which case you follow and duplicate deals yourself.

Additionally, there is a semi-automated alternative in which you select which positions to copy while the platform conducts trades.

Choose traders who employ a variety of tactics at first, try things out with a demo account, and then progressively raise your investment as you monitor results.

This method assists in the gradual improvement of your trading technique.

Benefits and Risks of Copy Trading

Copy trading provides a quick route to market exposure and education by imitating the techniques of seasoned traders, allowing even the busiest people to participate in the market.

This method’s automation helps eliminate emotional biases and promotes more logical decision-making.

Users can customise their portfolios by choosing traders that meet their risk tolerance and financial objectives and possibly achieve varied and successful results.

Yet, there are dangers associated with depending on the advice of another trader because past performance does not guarantee future outcomes. Unexpected losses may result from market volatility, geopolitical crises, and liquidity problems.

Furthermore, there may be expenses involved in trading frequently and adhering to signal providers. It’s crucial to diversify and handle investments wisely in order to reduce these dangers.

Copy trading provides access to a variety of assets, including cryptocurrencies, equities, and FX. Depending on your objectives for market exposure, each asset class has different risk profiles and techniques; thus, picking the best trader to follow will differ.

Technical traders who want to make quick profits are drawn to forex, but equities have a more comprehensive range of chances across different industries.

Despite their reputation for volatility, cryptocurrencies have grown in popularity due to their large potential rewards.

Furthermore, fractional share trading gives investors access to top companies with reduced capital requirements by allowing them to purchase sections of high-value equities.

The Top 3 Platforms for Copy Trading

Choosing the correct platform is essential for successful copy trading investing, which may be simple and profitable. Extensive study and performance comparisons are required to optimise returns.

B2COPY

B2COPY is a well-known platform that provides social trading, PAMM, MAM, and compatibility with MT4/5 and cTrader. Its user-friendly web interface enables users to monitor and manage trades. B2COPY is a service that may be integrated with other platforms or used independently.

AvaTrade

Forex, indices, and commodities are just a few of the financial instruments available on AvaTrade, which is renowned for its easy-to-use interface.

It’s perfect for novices with a $100 minimum deposit with risk control tools and real-time statistics. Its copy trading options and sophisticated tools are a little limited.

eToro

An appreciated option for novices is eToro, which offers an easy-to-use interface, access to a wide range of markets, and a vibrant trading community.

Although it provides zero commission trades and risk management features, copy trading is restricted to one-way methods.

Final Thoughts

While copy trading can be a low-effort way to make money, it also involves giving up control over your investments. To maximise it, go cautiously, be aware of the dangers, and select your signals carefully.