In just a few months, 3 banks have been put under statutory management following questionable financials. It started with Dubai Bank, then Imperial Bank and yesterday Chase Bank.

Chase looked like a vibrant bank attractive to young customers.

However, behind closed doors, directors were issuing themselves loans of more than Sh1 billion each, putting a big strain on the books.

With these latest developments, what is the best place to bank your money?

It so happens that CBK has classified banks into tiers. Tier 1 is made up of the big old banks. These will almost certainly never go under in a similar way as Chase or Imperial. They have millions of clients and hundreds of billions in assets.

You can imagine the situation in Kenyan homes, towns and streets if say, Equity Bank went under. With over 8 million customers, that would effectively translate into a revolution and possibly the end of the government.

Tier 1 banks are definitely the safest. These belong to a category Americans like referring to as ‘Too big to fail’. Wikipedia defines it as follows, “Certain corporations, and particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by government when they face potential failure”

In 2008, the US government was forced to bail out their top tier banks following the financial crisis. JP Morgan Chase (No relation to Kenya’s Chase), Wells Fargo, and Citigroup received KSh 2.5 trillion each. Other banks received lesser amounts.

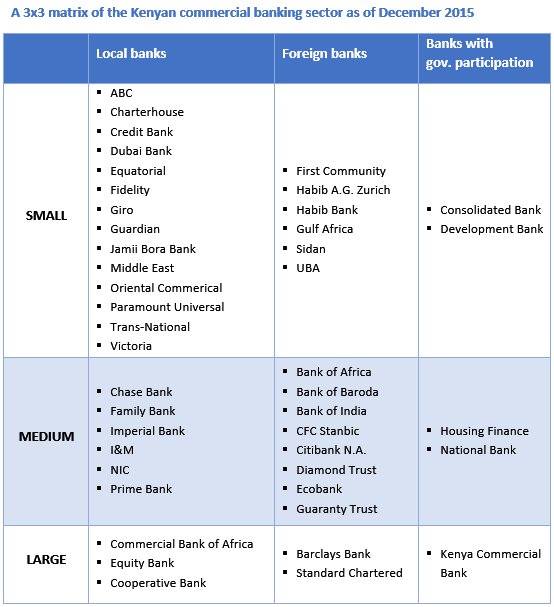

Here in Kenya, 6 banks make up the top tier, and collectively control 49.9% of the market.

16 other banks make up Tier 2, and collectively control 41.7% of the market.

The last tier, Tier 3 is made up of 21 small banks that control 8.4% of the market.

Tier 1

1. KCB

2. Equity Bank

3. Cooperative Bank

4. Standard Chartered

5. Barclays Bank

6. CBA

The Biggest in Tier 2

– CFC Stanbic

– NIC

– Diamond Trust Bank

– I&M

– Chase Bank

– Bank of Africa

– Family Bank

– Ecobank

– Housing Finance

Full list

Someone said that if your bank has no queues, it may be time to re-consider that partnership.