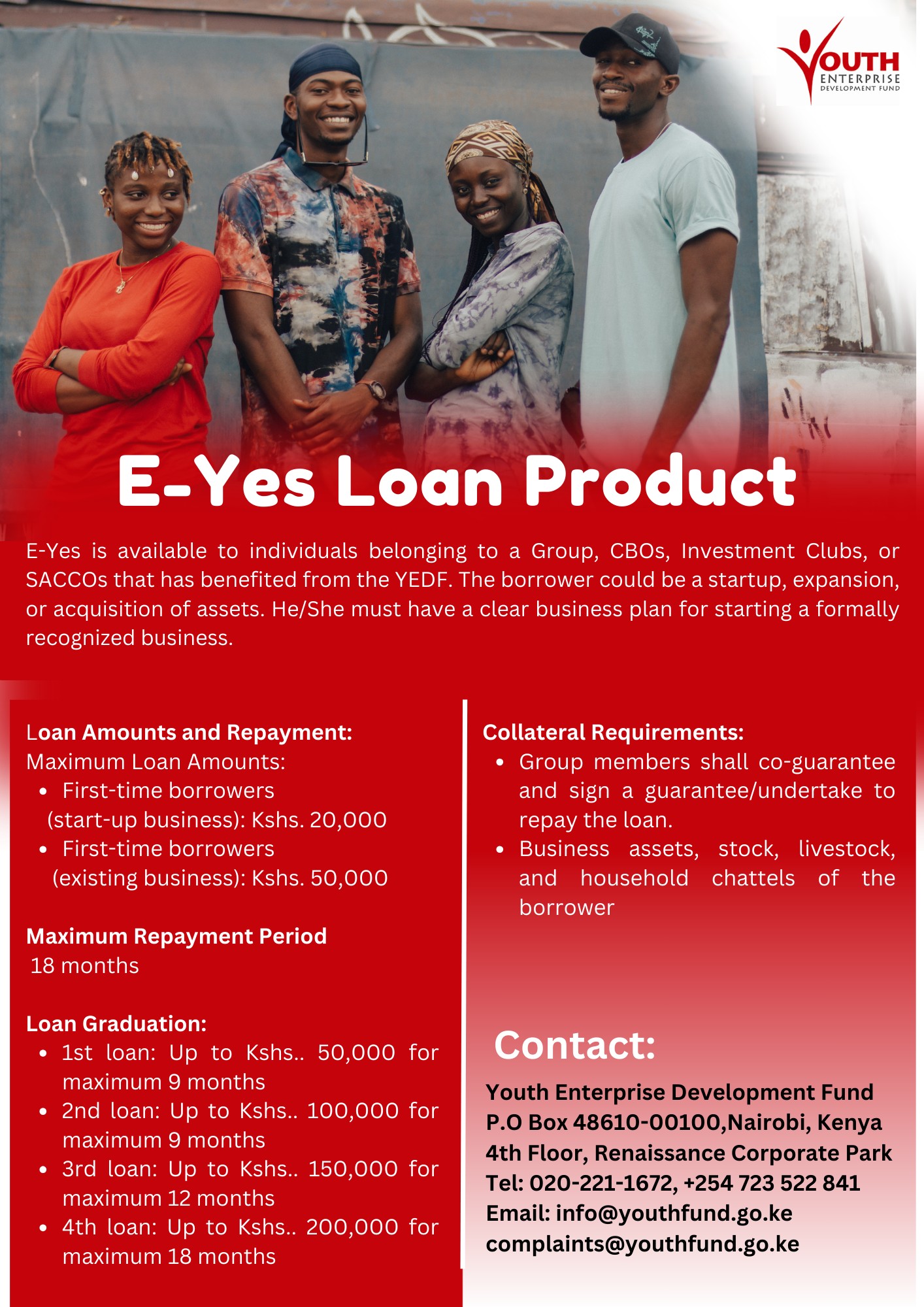

The Youth Fund has introduced a new loan product named E-Yes, expanding its financial offerings.

The Youth Fund has introduced a new loan product named E-Yes, expanding its financial offerings.

Announced on September 23, 2024, the E-Yes loan is available to individuals who are part of a group, Community-Based Organization (CBO), investment club, or Savings and Credit Cooperative Organization (SACCO) that has previously received support from the Youth Enterprise Development Fund (YEDF).

The Youth Fund encourages borrowers seeking financial assistance for startups, business expansion, or asset acquisition to apply for the E-Yes loan.

To qualify, applicants must present a clear business plan for a formally recognized business. The Youth Fund has set specific loan amounts and repayment rates for this product.

First-time borrowers looking to start a business can receive a maximum loan of Kes. 20,000, while those borrowing for the first time with an existing business can access up to Kes. 50,000. Borrowers in this latter category must repay their loans within 18 months.

Qualified individuals can also benefit from a loan graduation system, which includes the following:

- 1st Loan: Up to Kes. 50,000 for a maximum of 9 months.

- 2nd Loan: Up to Kes. 100,000 for a maximum of 9 months.

- 3rd Loan: Up to Kes. 150,000 for a maximum of 12 months.

- 4th Loan: Up to Kes. 200,000 for a maximum of 18 months.

To secure the E-Yes loan, group members must co-guarantee the loan and provide collateral, which includes business assets, stock, livestock, and household items.