The Kenyan Shilling has this week surprised many by making unexpected gains against the dollar. On Sunday, the official exchange rate was $1 = Ksh162.

The Kenyan Shilling has this week surprised many by making unexpected gains against the dollar. On Sunday, the official exchange rate was $1 = Ksh162.

Barely 3 days later, the Shilling has made probably some of the fastest gains in its history, by trading at $1 = ksh150 at the time of this writing. That’s Ksh 12 in a span of less than a week.

Normally, a gain such huge can take months if not years to materialize, which has led many Kenyans to wonder what is happening.

Although a stronger Shilling is ideal for most Kenyans, a section of the population benefits more when the dollar is stronger, which has led some to hoard the reserve currency in the last few months.

Some are now speculating that the dollar hoarders are ‘panic selling’, which has led to the rapid drop.

As everyone waits to see where this settles, things are thick at our Southern neighbours.

Last year, Tanzanian President Samia Suluhu mocked Kenya for having dollar shortages, but now it appears the shoe is on the other foot.

It has emerged that Tanzania is facing a dire shortage of dollars, which threatens their fuel imports. Kenya has previously found itself in this situation, particularly in 2022 when petrol stations saw huge queues any moment rumors of fuel availability would circulate.

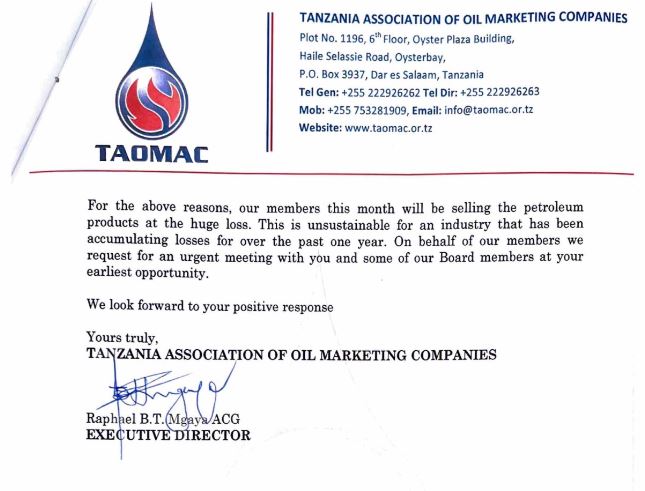

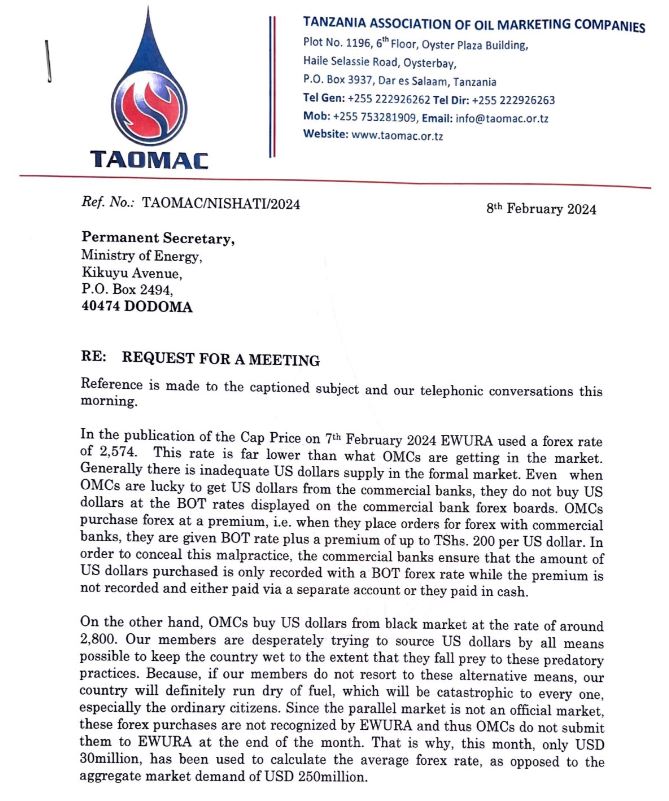

In a letter sent to Tanzania’s Permanent Secretary in the Ministry of Energy, the Tanzanian Association of Oil Marketing Companies (TAOMAC), has requested an urgent meeting to discuss the forex situation in the country.

They are decrying a mismatch in the dollar rates quoted by Tanzania’s energy regulatory body (EWURA), and what the market is actually offering.

They also cite the general lack of dollars in the formal market like commercial banks, which is leading them to buy from the black market at a steep markup of over Tsh226 (Ksh13).

The oil marketers warn that there’s a risk the country could run into a catastrophic lack of fuel if this is not fixed.

They also mention that because of these black market purchases, the official exchange rate between the Tanzanian Shilling and the US Dollar does not reflect reality.

Since fuel rates are dictated by EWURA, just like EPRA does here, the marketers state that their members are now selling fuel at a loss, and have been for the last one year. This could partly explain why Tanzanian fuel prices always seem to be about 10 shillings lower than Kenya.

Following the news, Ruto’s economic advisor David Ndii had some advice for President Suluhu and Tanzania. Posting on Twitter, Ndii said that “we are happy to share G to G structuring tips.”

The controversial and highly misunderstood G to G scheme was envisioned to prevent the situation we had in 2022, where our own oil marketers suffered a similar fate of lack of dollars.

While many Kenyans thought the scheme meant paying for oil in Kenya Shilling, that was only half the truth. In reality, the Shilling was put in an escrow account, which was later converted into dollars at an agreed date.

This was designed to ease forex pressures, since oil marketing companies were not obliged to scoop up all the dollars in the country every day, leading to shortages.

It remains to be seen whether Tanzania will adopt a similar model.