Despite its vast potential, the blockchain landscape is characterized by fragmentation, with individual blockchains functioning in silos, diverging from the core philosophy of decentralization.

However, the advent of cross-chain swaps heralds a new era, offering the prospect of fluid transactions between blockchains and paving the way for enhanced interoperability and cohesion.

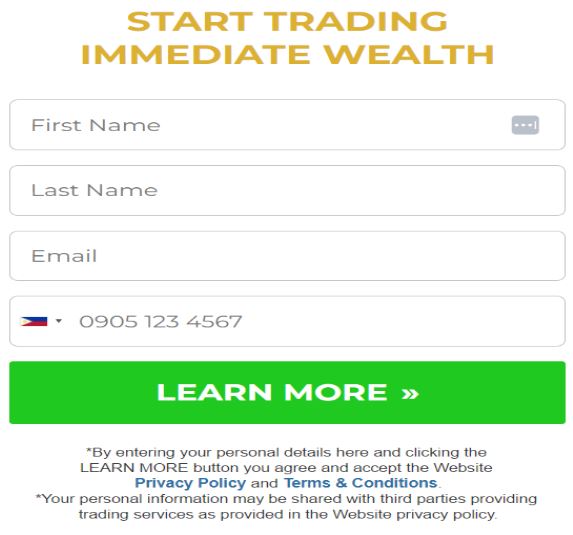

Click this image below to start bitcoin trading.

Basics of Bitcoin and Its Protocol Improvements

In 2009, the financial landscape witnessed a groundbreaking shift with the inception of Bitcoin, marking the birth of the first decentralized cryptocurrency.

This revolutionary digital currency not only offered an alternative to traditional financial systems but also championed the cause of decentralization.

However, as with any pioneering technology, Bitcoin’s growing ecosystem highlighted areas for refinement.

To address these nuances, the community introduced Bitcoin Improvement Proposals (BIPs). These are collaborative efforts from the community, aiming to continually optimize and elevate the Bitcoin protocol to meet evolving demands.

Understanding BIP199 and HTLCs

BIP199 introduced Hash Time Locked Contracts (HTLCs), a pivotal mechanism for ensuring transactional security. HTLCs operate on the principle of locking funds with a cryptographic hash.

For the funds to be released, the recipient must produce a pre-agreed secret, ensuring that transactions either complete successfully or revert without any loss.

The introduction of HTLCs bolstered atomic swaps, a mechanism that allows for the exchange of one cryptocurrency for another without the need for intermediaries.

The atomic nature of these swaps ensures that the transaction either goes through for both parties or doesn’t execute at all, eliminating the risks associated with traditional exchanges.

The Mechanics of Atomic Swaps

The process of an atomic swap begins with Party A securing their funds in an HTLC. Once this is initiated, Party B reciprocates by also locking their assets within a similar contract.

Central to this transaction is the exchange of cryptographic secrets by both parties, which facilitates the release of the safeguarded funds.

Yet, there’s a safety net: if a confirmation isn’t achieved by either party within a predetermined time frame, the mechanism ensures the assets revert back to their original owners.

Extending Atomic Swaps to Altcoins

Bitcoin’s pioneering role in the crypto space paved the way for the development and implementation of atomic swaps, a technology that has now been adopted by various altcoins. Yet, the path to this broad adoption is layered with complexities.

Each blockchain boasts its distinct architecture and consensus methodology, making the integration of atomic swaps a nuanced endeavor that demands meticulous attention to detail.

Despite these challenges, numerous altcoins have made strides in this realm.

A notable example is Litecoin, which marked a significant milestone by completing a cross-chain atomic swap with Bitcoin in 2017. Events like these underscore the escalating significance of blockchain interoperability in today’s cryptocurrency landscape.

Real-world Implementations and Platforms

Within the dynamic realm of cross-chain swaps, Komodo and THORChain stand out prominently.

Komodo’s AtomicDEX decentralizes trading by allowing users to conduct atomic swaps directly from their wallets, while THORChain is distinguished for streamlining asset exchanges across varied blockchains with its cross-chain liquidity pools.

However, navigating challenges such as scalability and sustaining consistent liquidity, while ensuring a blend of transactional safety and efficiency, remains paramount for these entities.

Future of Cross-chain Swaps and Interoperability

The future holds exciting possibilities for cross-chain interoperability.

Emerging technologies aim to enhance cross-chain capabilities further. Bridges, for example, are smart contract protocols that link two blockchains, allowing tokens from one chain to be used securely on another.

Wrapped tokens, another innovative solution, involve the issuance of tokens on a blockchain that represents assets from another chain, ensuring asset portability across diverse blockchains.

Moreover, the impact on decentralized finance (DeFi) cannot be understated.

As more platforms adopt cross-chain mechanisms, we can expect a more cohesive, integrated, and functional DeFi landscape, free from the constraints of isolated blockchains.

Conclusion

The blockchain world stands at the cusp of a revolution. The promise of a seamlessly integrated ecosystem is closer than ever, thanks to mechanisms like BIP199’s HTLCs and the proliferation of cross-chain swaps.

This ensures that the blockchain world is not just a collection of isolated islands but a cohesive, interconnected continent.