President William Ruto’s economic advisors have echoed the president’s recent declaration that the Kenya Kwanza government has stabilized the economy.

President William Ruto’s economic advisors have echoed the president’s recent declaration that the Kenya Kwanza government has stabilized the economy.

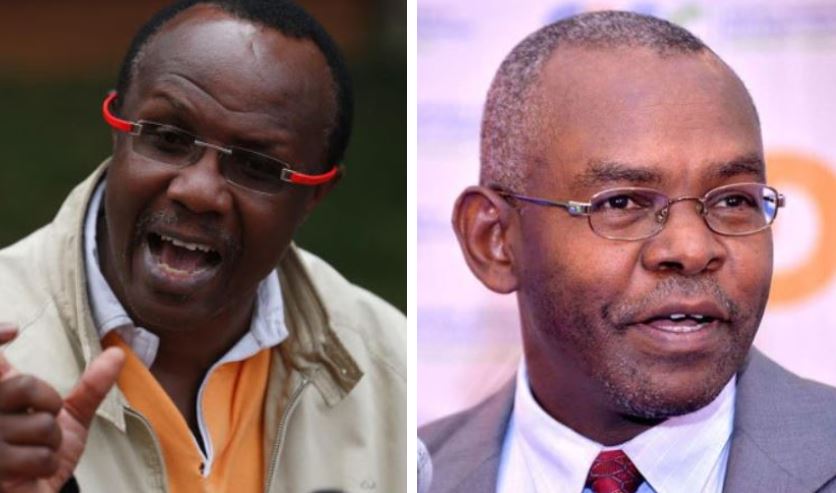

David Ndii, the President’s economic advisor, says even though Kenya is not out of the woods yet, the cost of living is expected to drop in the next month and return to normal in the next financial year.

“We are confident about the turnaround. The future is looking better now. Inflation is coming down, in January 2023 it was at 9 per cent down from 9.6 per cent in November. Treasury has estimated seven per cent by end of the calendar year,” he said.

Budget Deficit

Ndii said that when President Ruto took over, the deficit that had been approved by the previous administration was Sh862 billion, and an additional Sh297 billion was not accounted for, meaning the real deficit Ruto found was at Sh1.159 trillion.

Dr Ndii added that by the time Ruto was sworn into office, the country was experiencing difficulties borrowing from the international market.

He said economic austerity, removing subsidies and fiscal discipline were necessary to prevent the country from plunging into crisis.

“We needed a quick intervention to save the situation. The President said he will bite the bullet and go for austerity. Today, we have improved our fiscal framework, the inflation is down to Sh834 billion and inflation is coming down,” he said.

“We knew from the word go that we were in a financial crisis. We had to make tough decisions or go the Sri Lanka, Ghana way. Everyone else was saying Kenya would be the next country to plunge into an economic crisis and indeed were it not for the decisive position by the President on the austerity, we would have gotten there, but fiscal discipline by the government saved the situation,” Ndii claimed.

The economist explained that the Sh300 billion austerity ordered by Ruto slowed down the country’s borrowing.

“Our domestic interest rates have not gone up given the pressure on the dollar, so marginal increases. Our bond yields have declined from around 17 per cent to below 10.5 per cent,” he said as quoted by the Standard.

Investor Confidence

In the same interview, former Treasury PS Kamau Thugge, also an advisor in the Kenya Kwanza government, said investor confidence in Kenya had increased since Rutoo took over.

“When we came in, our bonds were trading at a discount of 17 per cent…today we have brought it down to 10.5 per cent. Domestic borrowing, we could not get the money. We always went to the market and came back less. Now they are lending to us and the private sector,” he said.

Thugge added: “The reason why banks were not lending to the government was because of risk. The international market as well has embraced us.”

“This means that if we go on this path, we have tidied ourselves through this crisis and can now go to our development.”

The economist predicted that in the next year, the country’s economic situation will be strong enough to stop borrowing domestically.

“We are looking at the situation in the next year or so when we will stop borrowing from the local market and the banks will have a lot of money to hawk to the private sector, which is the driver of the economy,” Thugge said.

The economists also said the World Bank is willing to inject $1 billion (Sh128 billion) into the economy . They claimed some international capital market players had also pledged a similar amount on or before the beginning of the next financial year.

“This indicated that warm reception international lenders now have with Kenya, they are amazed at the fiscal discipline we have exuded,” said Thugge.

Dollar Shortage

On the issue of dollar shortage in the countr, Ndii said they were in talks with some giant fuel firms in the Gulf to enter into long-term contracts that can allow Kenya to pay for fuel even after six months.

“This move will ease pressure on the demand for dollars to buy fuel, we import fuel worth $500 million every month,” said Ndii.

“This means we continue to deplete our reserves with every purchase. But in the current arrangement, we will have dollar reserves with us for six months circulating before we release to pay fuel.”

On subsidies, he said it did not make sense for the country to spend billions on cushioning food prices when there was no production.

“We reasoned that instead let’s put the billions in production. This will afford us a lasting solution on food security while at the same time putting money in people’s pockets through sale of the food.”