Safaricom Public Limited Company (PLC) is the leading mobile service provider in Kenya, with a market share of 68.2% as of 2021. It has invariably ranked high in the Nairobi Securities Exchange (NSE) since it was inducted in June 2009, and it has continued to outplay its competitors to be Kenya’s best employer in the LinkedIn 2022 Top Companies Ranking.

Its industry success has always been attributed to marketing tactics that woo the investors to entrust their funds to the first growing telecom service company, which offers services such as mobile money transfer, telephony, consumer electronics, e-commerce, cloud computing, data, and fiber optic services.

After Safaricom was incepted in 1997, Vodafone Group PLC moved to acquire a 40% stake and was given the management role of the company. In 2008, immediately after it was instated into NSE, the government offered 25% of its shares to be traded by the members of the public.

Safaricom’s performance consistency and its financial sustainability have played a part in boosting investors’ confidence who engage in the buying and selling of the shares. The current shareholding structure of Safaricom is:

* Government of Kenya – 35%

* Vodacom – 35%

* Vodafone – 5%

* Free float (public investment stocks) – 25%

Requirements To Buy Safaricom Shares

Every investor wants to be part of the most profitable company in Kenya and even among the leading corporates in Africa – Safaricom PLC.

To be among Safaricom investors’ team, you must be a shareholder with the giant Telco, whose financial reports gross billions of shillings when annual reports are released. Safaricom was estimated to make over Ksh196 million a day in 2021 with a net profit of Ksh68.67 billion in their fiscal year that ended in March of that year.

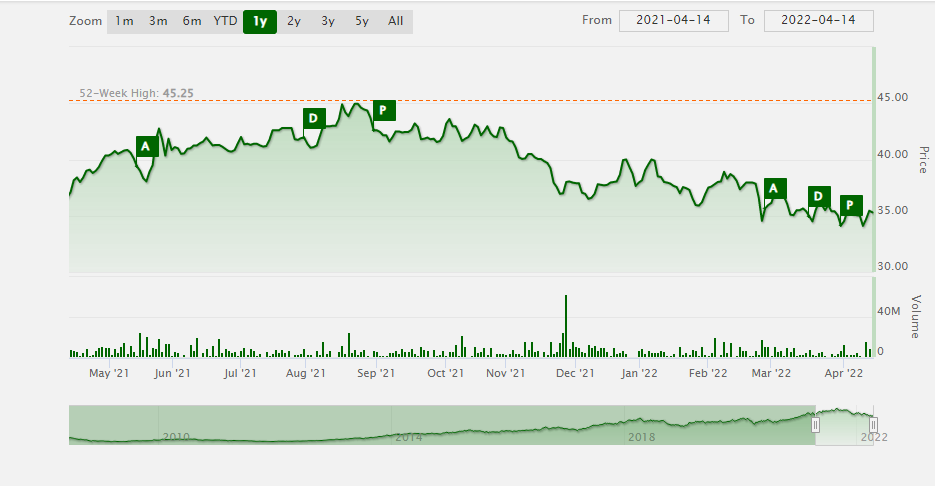

How much are Safaricom shares? The average price of one Safaricom share is Ksh33 to Ksh50. The lowest Safaricom share price was Ksh2.90 recorded in 2011 and the highest of Ksh43.50 in May 2021. The minimum number of SCOM shares that one can buy from NSE is 100 shares. But what are the requirements for buying Safaricom shares?

1. Have a CDS account

Central Depository System (CDS) is a digital account licensed by Capital Markets of Kenya to facilitate transactions of the Nairobi Securities Exchange (NSE), including buying and selling of shares and regulating listed and non-listed securities to protect the interests of the investors.

Central Depository & Settlement Corporation Limited (CDSC) issues CDS accounts to first-time investors who seek to achieve financial goals in the stocks market. What are the requirements for opening a CDS account in Kenya?

* 2 clear passport size photos

* Original ID or a valid passport

* Certificate of incorporation for corporates

* Certificate of registration for organizations

To open a CDS account online in Kenya, you need to download the CDSC application available on Google Play Store or Apple Store, fill in your contact details, upload your registration documents and submit. Once you’re done with submission, you will receive a username and a PIN for your logins. Also, a CDS account can be opened through USSD service *543#.

2. Safaricom shares eligibility criteria

Purchase of Safaricom shares can be conducted by both individuals and business entities. There are different requirements for each shareholder depending on which category they fall in.

Requirements for individuals

* Be able to make the first purchase of 500 shares

* Pay a non-refundable fee of Ksh10,000

* Make a monthly contribution of Ksh3,000

* Have a KRA pin

* Submit your Credit Reference Bureau (CRB) report

Requirements for Chamas (self-help groups)

* The group must be registered with the Ministry of Gender, Children and Social Development

* Pay a registration fee of Ksh25,000 non-refundable

* Buy a minimum share capital of 1500 shares

* Pay a monthly contribution of Ksh15,000

3. Have an active transaction account

One can buy Safaricom shares using banks, Mpesa, or Bonga points. To make payments to facilitate buying of shares, you must have an active bank account or a Mpesa account. Alternatively, one can purchase shares using stockbrokers under Nairobi Securities Exchange and are listed on the CDSC app. Stockbrokers usually use cash or bank cheques as their payment modes.

Buying shares through a stockbroker does not mean that you have to go and have a physical meeting with them. You can select your best stockbroker through a thorough analysis on their website, checking if they are licensed to operate in Kenya, their payment methods, commissions, and additional costs.

Each stockbroker has different payment modes, with some accepting mobile money transactions and a number of them allowing for only bank and international money transfer methods. Below is a list of the best stockbrokers in Kenya, listed in NSE with the approval of the Central Bank of Kenya (CBK):

* Drummond Investment Bank

* Dyer & Blair Investment Bank Ltd

* Francis Thuo & Partners Ltd

* Nyaga Stockbrokers Ltd

* Ngenye Kariuki & Co. Ltd

* Suntra Investment Bank Ltd

* Reliable Securities Ltd

* CFC Financial Services

* Kingdom Securities Ltd

* ABC Capital Ltd

* ApexAfrica Investment Bank Ltd

* Standard Investment Bank Ltd

* Renaissance Capital (Kenya) Ltd

How To Buy Safaricom Shares via Mpesa

Safaricom provided a way for investors to easily buy its shares by transacting on Mpesa to avoid large bank queues, which have, in the past, proven hectic and tedious for those with busy days. How can you buy Safaricom shares using Mpesa? Here are the easy steps:

1. Go to your Safaricom sim toolkit

2. Select ‘Lipa na Mpesa’

3. Go to ‘Pay Bill’

4. Enter your stockbroker’s pay bill number or use Safaricom Investment Cooperative SIC pay bill number 163163

5. Enter the individual/entity’s name as the account number

6. Buy the shares after reviewing the current market price of each share. The number of shares depends on the capital that you wish to invest in stocks

How To Buy Safaricom Shares via Bank

Many banks have subsidiaries that operate as stockbrokers, buying and selling shares on their behalf. This has made purchasing of shares by investors possible as they have to only choose their desired bank, link it to their CDS account and start trading in shares. How can you buy Safaricom shares using a bank?

1. Choose your preferred bank which is listed in NSE and able to trade in SCOM shares

2. Pay using their account number and wait for them to purchase shares on your behalf

Also, you can use Safaricom Investment Cooperative SIC Cooperative bank account number 01120150100700, Westlands Branch.

How To Buy Safaricom Shares Using Bonga Points

Bonga points is a loyalty scheme instituted by Safaricom as a way of rewarding its customers for using their prepaid and postpaid services.

Customers earn a point for every Ksh10 spent on data and purchase of talk time. Additionally, frequent use of services such as Mpesa means getting significant amounts of Bonga points, which are usually redeemable for merchandise and offers.

Not only is Bonga points exchangeable for one-time offers such as airtime, gadgets, transport tickets, and SMS, but also can be converted into a long time investment that will help you achieve your financial goals – Bonga points can be used to purchase Safaricom shares using these easy steps:

1. Dial *126# on your phone

2. Select ‘Lipa na Bonga Points’ option 2

3. Choose option 2 ‘Pay Bill’

4. Enter the stockbroker’s business number

5. Enter the CDS account number as the account name

6. Enter the amount of money you wish to deposit into your CDS account – Remember 5 Bonga points is the equivalent of Ksh1

7. log in to your CDS account and start buying Safaricom shares