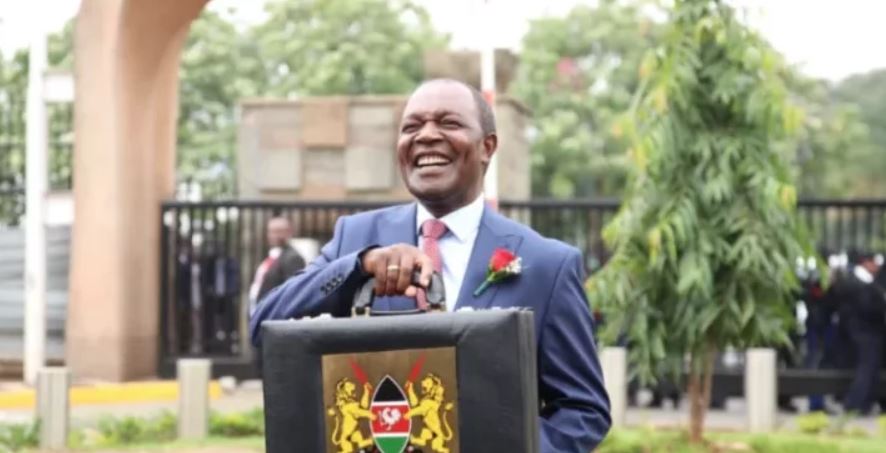

“The Capital Markets (Online Forex Exchange Trading) Regulations, 2017, hereinafter referred to as the “principal Regulations”, are amended by inserting the following new regulation immediately after regulation 25,” Prof Ndung’u said.

“An online forex broker shall pay to the Authority an annual fee based on the gross trading revenue which shall include the commissions and rebates from third-party related service providers for that year, at the rate specific in the Third Schedule,” he added.

Under the newly introduced regulations, both dealing and non-dealing online forex brokers will be required to contribute an annual three percent fee to the Capital Market Authority(CMA).

This fee will be calculated based on their gross revenue, encompassing commissions and rebates.

The charge on online forex brokers coincides with the heightened protection provided by the CMA to currency traders and clients.

The capital markets regulator has formed a working group that includes the licensed Forex brokerage community and other stakeholders to collaboratively establish standards aimed at enhancing consumer protection.

“In an effort to foster and deepen growth in the online forex trading industry, CMA has facilitated setting up of a Technical Working Group comprising of the licensed online foreign trading brokers as well as other stakeholders including peer regulators to assess the state of the market and propose recommendations to mitigate the challenges faced by investors, traders and licensed players,” said CMA CEO Wycliffe Shamiah.