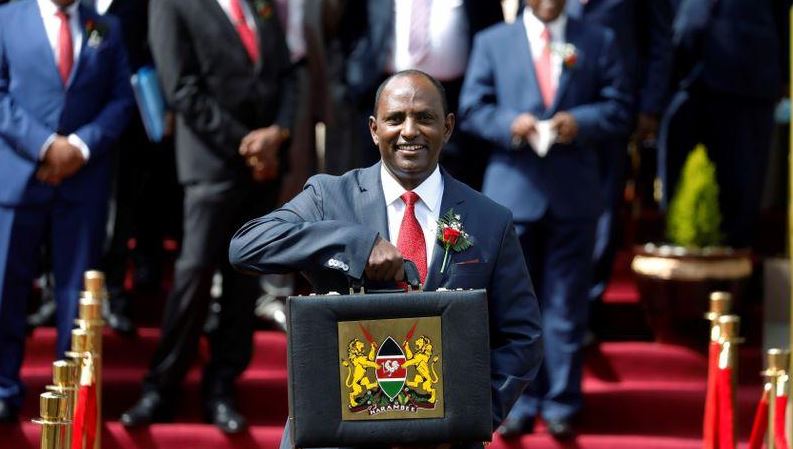

In the Sh3.66 trillion FY 2021/22 budget estimates, the Big Four Agenda items have been allocated Sh135 billion. The post-Covid-19 economic recovery (fiscal stimulus) strategy is also not prominent. What does this mean to Kenya’s recovery from your assessment? – Davis Basweti Ombane, Juja

The government has mainstreamed the post covid-19 economic recovery strategy and will be rolling it out soon. The fundamental pillar of the strategy is sound macro-economic management.

The other key pillars are accelerated growth in private sector investment; enhanced allocation to strengthen health care systems; supporting the recovery and growth of micro, small and medium enterprises (MSMEs); full implementation of the Economic Stimulus Programme (ESP); up-scaling investment in ICT and digital infrastructure; facilitating clean, green and resilient growth; enhancing resilience of the economy to global economic shocks; and better disaster preparedness and management. In addition, the government will pay attention to governance, inequality, social cohesion, gender, youth, regional integration and international cooperation.

These pillars have received significant focus and allocation in the FY 2021/22 budget estimates.

With regards to the Post Covid-19 Economic Stimulus Programme (PC-ESP), the government has allocated Sh26.6 billion as follows: Sh8.6 billion to enhance business liquidity; Sh6.4 billion to improve education outcomes; Sh7.4 billion to improve environment, water and sanitation facilities; Sh1.97 billion to improve agriculture and food security; Sh1.2 billion to recruit health interns; and Sh1 billion for the Kenya Wildlife Services to engage community scouts.

Also note that the government is committed to providing an enabling environment to the private sector, which remains the driver and engine of economic growth.

It is over a year now since the president announced the government’s plan to assist SMEs with soft loans through seven selected banks. Can you assure us that the same is being implemented as promised? – Francis N Mwangi, Kariobangi South

We are implementing various initiatives to advance credit to MSMEs. In particular, the State Department for Industrialisation, through the Kenya Industrial Estates (KIE), is offering credit to MSMEs in the manufacturing sector.

Additionally, through the ESP, we are implementing components to de-risk lending to MSMEs by operationalising the Credit Guarantee Scheme whose budgetary provision in the FY 2020/21 was Sh3 billion.

However, the implementation of the scheme was delayed by the lack of an enabling legal framework, which then occasioned the amendment of the Public Finance Management Act to empower the Treasury Cabinet Secretary to establish the Credit Guarantee Scheme, alongside the regulations prescribing the operations of the scheme.

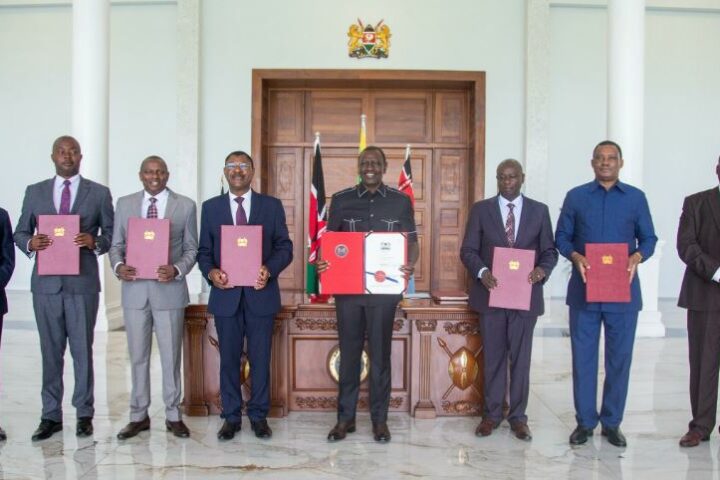

With these now in place, Treasury has since rolled out the Scheme through the execution of Credit Guarantee Scheme agreements with seven commercial banks that were competitively selected.

Finally, through the post Covid-19 economic recovery strategy, the government will enhance the implementation of the MSMEs Credit Guarantee Scheme, capacity building programmes and ICT platforms to improve productivity and competitiveness.

Vaccinating a majority of the population holds the key to economic recovery. However, Treasury does not seem to appreciate this and at some point, the Nation Assembly’s Budget and Appropriations Committee was dismayed that Treasury had not allocated any money for vaccines. How could this happen? How much are you allocating to vaccines? – Bernice Waswa, Eldoret

Treasury, and indeed the entire government, recognises that vaccinating a majority of the population is key to our economic recovery efforts. Kenya began vaccinating against Covid-19 in early March 2021. The vaccination programme relies in part on vaccines obtained via the Covax Initiative, which over time is expected to provide vaccines sufficient to cover 20 percent of the population.

The government plans to procure vaccines to inoculate an additional 40 percent of the population in three phases stretching to mid-2023.

The vaccination programme is being fast-tracked, with the national target being raised from the initial 30 percent of the population by 2023 to 60 percent within the same period, even as supply constraints are addressed and the list of vaccines is broadened to include the Johnson & Johnson vaccine.

The government set aside Sh7.6 billion in FY 2020/21 for the purchase of vaccines. This amount has been included in the Second Supplementary Budget for FY 2020/21, which will soon be tabled in Parliament. Treasury will provide an additional Sh14 billion for vaccines in FY 2021/22.

Experts say the proportion of Kenya’s budget allocated to debt payment and recurrent expenditure leaves little room to spend on development, requiring more borrowing. What is your view on this? – John Juma

Kenya’s debt remains sustainable and we have not defaulted on any of our obligations. Our capacity and commitment to servicing our debt has been impressive, which explains why Kenya was not part of the Highly Indebted Poor Countries (HIPC) initiative.

The Covid-19 pandemic and the relief we offered to Kenyans affected our domestic revenue collection and reduced our exports, thus affecting some of our debt sustainability indicators. Due to the ongoing vaccination and other control measures, we are optimistic that the negative effects of the pandemic will be contained and lead to improved revenue collection.

It is worthwhile to note that the debt being serviced was used to finance the development or capital projects such as roads, water and sanitation projects, power generation and distribution and health care facilities.

Reduced revenue mobilisation due to the Covid-19 pandemic and the need to safeguard critical recurrent expenditures and debt servicing explain lower spending on development. However, over the medium term, development expenditure is expected to increase as the economy recovers.

Kenya’s development partners have proposed cost-cutting measures to stabilise the country’s economy that will include downsizing of the public service to tame the ballooning public wage bill. Going by the experience of the Structural Adjustment Programme of the 90s, do you think this is the best approach after we have witnessed massive job losses due to Covid-19? – Dan Murugu, Nakuru

We recognise that unsustainable growth in the public sector wage bill limits the ability of the government to fund critical services. In view of this, the government has instituted various administrative reforms to contain and manage the wage bill, including ongoing efforts by the Salaries and Remuneration Commission to harmonise salaries.

These efforts continue to bear fruit. In the last five years, the national government wages (civil service, teachers, police and prison officers) have averaged 4.5 percent of GDP and this is expected to drop to about 4 percent by the end FY 2022/23.

The government has not adopted any policy regarding downsizing of the public service and we are not aware of any such plans. However, all new recruitments will be controlled and where possible, limited to health, education and security sectors.

Considering the debt repayment burden and the struggle to collect enough revenue, can you please answer this question honestly and directly: Is the government broke? – John Ouma, Nairobi

I wish to assure the general public that the government is not broke. However, the Covid-19 pandemic has slowed down economic activities, not only in Kenya but globally.

This has a direct impact on the government’s ability to generate additional resources to fund our priorities.

We are, however, prudently managing the available resources to ensure continuity in service delivery. The government continues to meet all its financial obligations, including debt service payments, without fail.